Page 38 - FY 2021-22 ADOPTED BUDGET

P. 38

FUND/DEPARTMENT RELATIONSHIPS

The City of Benbrook’s 2021-22 Budget focuses on the Operating Funds. The Operating Funds Budget is approved

by the Benbrook City Council each year through the adoption of two ordinances: the Budget Allocation Ordinance

and the Property Tax Rate Ordinance; copies of these ordinances are included in the 2021-22 Budget.

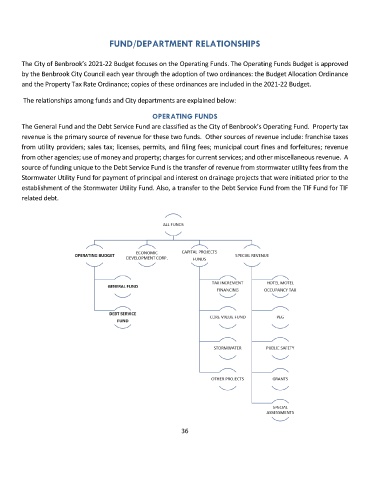

The relationships among funds and City departments are explained below:

OPERATING FUNDS

The General Fund and the Debt Service Fund are classified as the City of Benbrook’s Operating Fund. Property tax

revenue is the primary source of revenue for these two funds. Other sources of revenue include: franchise taxes

from utility providers; sales tax; licenses, permits, and filing fees; municipal court fines and forfeitures; revenue

from other agencies; use of money and property; charges for current services; and other miscellaneous revenue. A

source of funding unique to the Debt Service Fund is the transfer of revenue from stormwater utility fees from the

Stormwater Utility Fund for payment of principal and interest on drainage projects that were initiated prior to the

establishment of the Stormwater Utility Fund. Also, a transfer to the Debt Service Fund from the TIF Fund for TIF

related debt.

36