Page 128 - FY 2021-22 ADOPTED BUDGET

P. 128

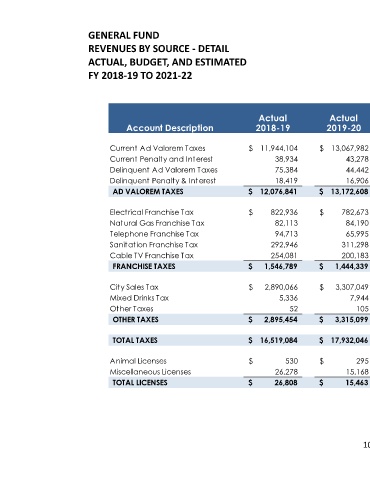

GENERAL FUND

REVENUES BY SOURCE - DETAIL

ACTUAL, BUDGET, AND ESTIMATED

FY 2018-19 TO 2021-22

Variance

Actual Actual Budget Estimated Favorable Budget

Account Description 2018-19 2019-20 2020-21 2020-21 (Unfavorable) 2021-22

Current Ad Valorem Taxes $ 11,944,104 $ 13,067,982 $ 13,717,061 $ 13,678,662 $ 308,902 $ 13,987,564

Current Penalty and Interest 38,934 43,278 35,000 35,000 - 35,000

Delinquent Ad Valorem Taxes 75,384 44,442 50,000 50,000 - 50,000

Delinquent Penalty & Interest 18,419 16,906 20,000 25,000 (5,000) 20,000

AD VALOREM TAXES $ 12,076,841 $ 13,172,608 $ 13,822,061 $ 13,788,662 $ 303,902 $ 14,092,564

Electrical Franchise Tax $ 822,936 $ 782,673 $ 800,000 $ 780,165 $ (165) $ 780,000

Natural Gas Franchise Tax 82,113 84,190 85,000 90,000 (5,000) 85,000

Telephone Franchise Tax 94,713 65,995 80,000 40,000 - 40,000

Sanitation Franchise Tax 292,946 311,298 350,000 350,000 0 350,000

Cable TV Franchise Tax 254,081 200,183 175,000 157,000 (2,000) 155,000

FRANCHISE TAXES $ 1,546,789 $ 1,444,339 $ 1,490,000 $ 1,417,165 $ (7,165) $ 1,410,000

City Sales Tax $ 2,890,066 $ 3,307,049 $ 3,250,000 $ 3,250,000 $ - $ 3,250,000

Mixed Drinks Tax 5,336 7,944 4,500 4,500 - 4,500

Other Taxes 52 105 - 100 (100) -

OTHER TAXES $ 2,895,454 $ 3,315,099 $ 3,254,500 $ 3,254,600 $ (100) $ 3,254,500

TOTAL TAXES $ 16,519,084 $ 17,932,046 $ 18,566,561 $ 18,460,427 $ 296,637 $ 18,757,064

Animal Licenses $ 530 $ 295 $ 400 $ 400 $ - $ 400

Miscellaneous Licenses 26,278 15,168 10,000 12,000 (2,000) 10,000

TOTAL LICENSES $ 26,808 $ 15,463 $ 10,400 $ 12,400 $ (2,000) $ 10,400

108