Page 162 - City of Bedford FY22 Budget

P. 162

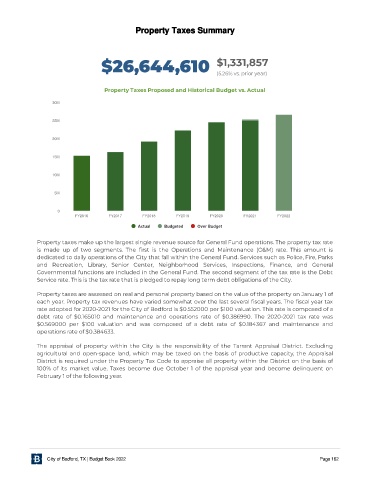

Property Taxes Summary

"26,644,610 $1,331,857

(5.2 6% vs. prior year)

Pr op er t y T a xes Pr op osed a n d H i st or i ca l Bu d get vs. Act u a l

30M

25M

20M

15M

10M

5M

0

FY2016 FY2017 FY2018 FY2019 FY2020 FY2021 FY2022

Actual Budgeted Over Budget

Prope rt y t ax e s mak e u p t he large st single re v e nu e sou rce for Ge ne ral Fu nd ope rat ions. The prope rt y t ax rat e

is made u p of t wo se gme nt s. The { rst is t he Ope rat ions and Maint e nance (O& M) rat e . This amou nt is

de dicat e d t o daily ope rat ions of t he C it y t hat fall wit hin t he Ge ne ral Fu nd. Se rv ice s su ch as Police , Fire , Park s

and R e cre at ion, Library, Se nior C e nt e r, Ne ighborhood Se rv ice s, Inspe ct ions, Finance , and Ge ne ral

Gov e rnme nt al fu nct ions are inclu de d in t he Ge ne ral Fu nd. The se cond se gme nt of t he t ax rat e is t he De bt

Se rv ice rat e . This is t he t ax rat e t hat is ple dge d t o re pay long t e rm de bt obligat ions of t he C it y.

Prope rt y t ax e s are asse sse d on re al and pe rsonal prope rt y base d on t he v alu e of t he prope rt y on Janu ary 1 of

e ach y e ar. Prope rt y t ax re v e nu e s hav e v arie d some what ov e r t he last se v e ral { scal y e ars. The { scal y e ar t ax

rat e adopt e d for 20 20 -20 21 for t he C it y of Be dford is $0 .5520 0 0 pe r $1 0 0 v alu at ion. This rat e is compose d of a

de bt rat e of $0 .1 6 50 1 0 and maint e nance and ope rat ions rat e of $0 .386 9 9 0 . The 20 20 -20 21 t ax rat e was

$0 .56 9 0 0 0 pe r $1 0 0 v alu at ion and was compose d of a de bt rat e of $0 .1 84 36 7 and maint e nance and

ope rat ions rat e of $0 .384 6 33.

The appraisal of prope rt y wit hin t he C it y is t he re sponsibilit y of t he Tarrant Appraisal Dist rict . E x clu ding

agricu lt u ral and ope n-space land, which may be t ax e d on t he basis of produ ct iv e capacit y, t he Appraisal

Dist rict is re qu ire d u nde r t he Prope rt y Tax C ode t o appraise all prope rt y wit hin t he Dist rict on t he basis of

1 0 0 % of it s mark e t v alu e . Tax e s be come du e Oct obe r 1 of t he appraisal y e ar and be come de linqu e nt on

Fe bru ary 1 of t he following y e ar.

City of Bedford, TX | Budget Book 2022 Page 162