Page 370 - Microsoft Word - FY 2022 Adopted Budget Document

P. 370

Appendices Return to Table of Contents

Return to Table of Contents

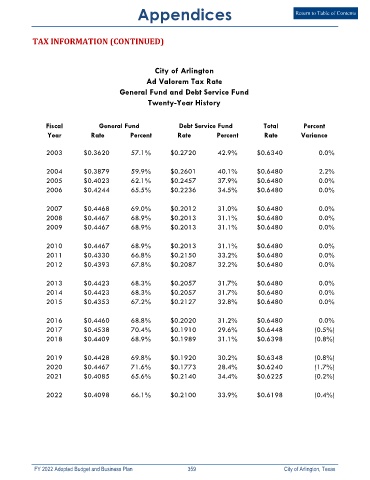

TAX INFORMATION (CONTINUED)

City of Arlington

Ad Valorem Tax Rate

General Fund and Debt Service Fund

Twenty-Year History

Fiscal General Fund Debt Service Fund Total Percent

Year Rate Percent Rate Percent Rate Variance

2003 $0.3620 57.1% $0.2720 42.9% $0.6340 0.0%

2004 $0.3879 59.9% $0.2601 40.1% $0.6480 2.2%

2005 $0.4023 62.1% $0.2457 37.9% $0.6480 0.0%

2006 $0.4244 65.5% $0.2236 34.5% $0.6480 0.0%

2007 $0.4468 69.0% $0.2012 31.0% $0.6480 0.0%

2008 $0.4467 68.9% $0.2013 31.1% $0.6480 0.0%

2009 $0.4467 68.9% $0.2013 31.1% $0.6480 0.0%

2010 $0.4467 68.9% $0.2013 31.1% $0.6480 0.0%

2011 $0.4330 66.8% $0.2150 33.2% $0.6480 0.0%

2012 $0.4393 67.8% $0.2087 32.2% $0.6480 0.0%

2013 $0.4423 68.3% $0.2057 31.7% $0.6480 0.0%

2014 $0.4423 68.3% $0.2057 31.7% $0.6480 0.0%

2015 $0.4353 67.2% $0.2127 32.8% $0.6480 0.0%

2016 $0.4460 68.8% $0.2020 31.2% $0.6480 0.0%

2017 $0.4538 70.4% $0.1910 29.6% $0.6448 (0.5%)

2018 $0.4409 68.9% $0.1989 31.1% $0.6398 (0.8%)

2019 $0.4428 69.8% $0.1920 30.2% $0.6348 (0.8%)

2020 $0.4467 71.6% $0.1773 28.4% $0.6240 (1.7%)

2021 $0.4085 65.6% $0.2140 34.4% $0.6225 (0.2%)

2022 $0.4098 66.1% $0.2100 33.9% $0.6198 (0.4%)

FY 2022 Adopted Budget and Business Plan 359 City of Arlington, Texas