Page 379 - Watauga FY21 Budget

P. 379

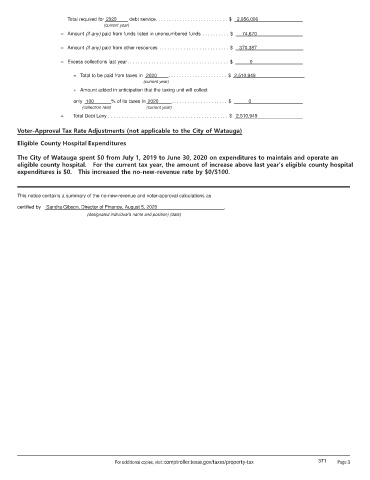

Total required for 2020 debt service. . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,956,006

(current year)

– Amount (if any) paid from funds listed in unencumbered funds . . . . . . . . . . $ 74,670

– Amount (if any) paid from other resources . . . . . . . . . . . . . . . . . . . . . . . . . . $ 370,387 ________________

– Excess collections last year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 0

= Total to be paid from taxes in 2020 . . . . . . . . . . . . . . . . . . . . . . $ 2,510,949

(current year)

+ Amount added in anticipation that the taxing unit will collect

only 100 % of its taxes in 2020 . . . . . . . . . . . . . . . . . . . . . $ 0

(collection rate) (current year)

= Total Debt Levy . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,510,949

Voter-Approval Tax Rate Adjustments (not applicable to the City of Watauga)

Eligible County Hospital Expenditures

The City of Watauga spent $0 from July 1, 2019 to June 30, 2020 on expenditures to maintain and operate an

eligible county hospital. For the current tax year, the amount of increase above last year’s eligible county hospital

expenditures is $0. This increased the no-new-revenue rate by $0/$100.

This notice contains a summary of the no-new-revenue and voter-approval calculations as

certified by Sandra Gibson, Director of Finance, August 5, 2020 .

(designated individual’s name and position) (date)

For additional copies, visit: comptroller.texas.gov/taxes/property-tax 371 Page 3