Page 27 - Southlake FY21 Budget

P. 27

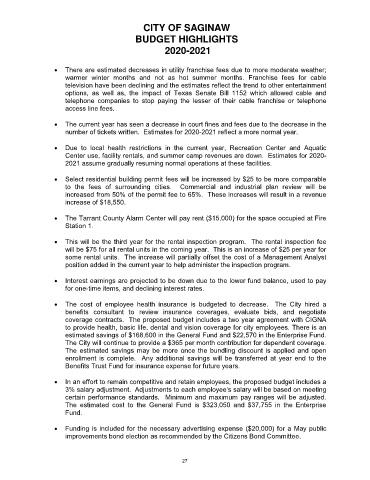

CITY OF SAGINAW

BUDGET HIGHLIGHTS

2020-2021

There are estimated decreases in utility franchise fees due to more moderate weather;

warmer winter months and not as hot summer months. Franchise fees for cable

television have been declining and the estimates reflect the trend to other entertainment

options, as well as, the impact of Texas Senate Bill 1152 which allowed cable and

telephone companies to stop paying the lesser of their cable franchise or telephone

access line fees.

The current year has seen a decrease in court fines and fees due to the decrease in the

number of tickets written. Estimates for 2020-2021 reflect a more normal year.

Due to local health restrictions in the current year, Recreation Center and Aquatic

Center use, facility rentals, and summer camp revenues are down. Estimates for 2020-

2021 assume gradually resuming normal operations at these facilities.

Select residential building permit fees will be increased by $25 to be more comparable

to the fees of surrounding cities. Commercial and industrial plan review will be

increased from 50% of the permit fee to 65%. These increases will result in a revenue

increase of $18,550.

The Tarrant County Alarm Center will pay rent ($15,000) for the space occupied at Fire

Station 1.

This will be the third year for the rental inspection program. The rental inspection fee

will be $75 for all rental units in the coming year. This is an increase of $25 per year for

some rental units. The increase will partially offset the cost of a Management Analyst

position added in the current year to help administer the inspection program.

Interest earnings are projected to be down due to the lower fund balance, used to pay

for one-time items, and declining interest rates.

The cost of employee health insurance is budgeted to decrease. The City hired a

benefits consultant to review insurance coverages, evaluate bids, and negotiate

coverage contracts. The proposed budget includes a two year agreement with CIGNA

to provide health, basic life, dental and vision coverage for city employees. There is an

estimated savings of $168,600 in the General Fund and $22,570 in the Enterprise Fund.

The City will continue to provide a $365 per month contribution for dependent coverage.

The estimated savings may be more once the bundling discount is applied and open

enrollment is complete. Any additional savings will be transferred at year end to the

Benefits Trust Fund for insurance expense for future years.

In an effort to remain competitive and retain employees, the proposed budget includes a

3% salary adjustment. Adjustments to each employee’s salary will be based on meeting

certain performance standards. Minimum and maximum pay ranges will be adjusted.

The estimated cost to the General Fund is $323,050 and $37,755 in the Enterprise

Fund.

Funding is included for the necessary advertising expense ($20,000) for a May public

improvements bond election as recommended by the Citizens Bond Committee.

27