Page 1 - Pantego Adopted Budget FY21

P. 1

Filed November 3, 2022

Tarrant County Clerk's Office

Mary Louise Nicholson

Tarrant County Clerk

TOWN OF PANTEGO, TEXAS

ANNUAL OPERATING BUDGET

AND PLAN OF SERVICES

FOR FISCAL YEAR 2020-2021

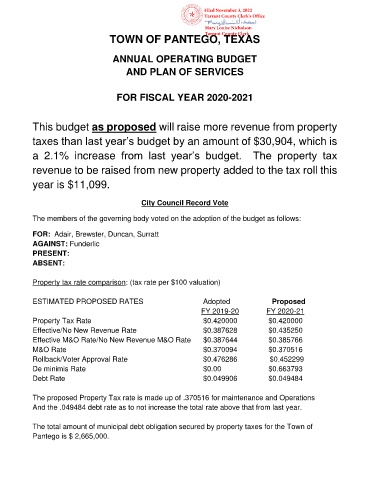

This budget as proposed will raise more revenue from property

taxes than last year’s budget by an amount of $30,904, which is

a 2.1% increase from last year’s budget. The property tax

revenue to be raised from new property added to the tax roll this

year is $11,099.

City Council Record Vote

The members of the governing body voted on the adoption of the budget as follows:

FOR: Adair, Brewster, Duncan, Surratt

AGAINST: Funderlic

PRESENT:

ABSENT:

Property tax rate comparison: (tax rate per $100 valuation)

ESTIMATED PROPOSED RATES Adopted Proposed

FY 2019-20 FY 2020-21

Property Tax Rate $0.420000 $0.420000

Effective/No New Revenue Rate $0.387628 $0.435250

Effective M&O Rate/No New Revenue M&O Rate $0.387644 $0.385766

M&O Rate $0.370094 $0.370516

Rollback/Voter Approval Rate $0.476286 $0.452299

De minimis Rate $0.00 $0.663793

Debt Rate $0.049906 $0.049484

The proposed Property Tax rate is made up of .370516 for maintenance and Operations

And the .049484 debt rate as to not increase the total rate above that from last year.

The total amount of municipal debt obligation secured by property taxes for the Town of

Pantego is $ 2,665,000.