Page 350 - N. Richland Hills General Budget

P. 350

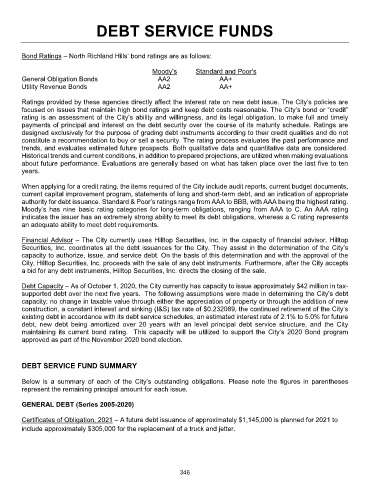

DEBT SERVICE FUNDS

Bond Ratings – North Richland Hills’ bond ratings are as follows:

Moody’s Standard and Poor’s

General Obligation Bonds AA2 AA+

Utility Revenue Bonds AA2 AA+

Ratings provided by these agencies directly affect the interest rate on new debt issue. The City’s policies are

focused on issues that maintain high bond ratings and keep debt costs reasonable. The City’s bond or “credit”

rating is an assessment of the City’s ability and willingness, and its legal obligation, to make full and timely

payments of principal and interest on the debt security over the course of its maturity schedule. Ratings are

designed exclusively for the purpose of grading debt instruments according to their credit qualities and do not

constitute a recommendation to buy or sell a security. The rating process evaluates the past performance and

trends, and evaluates estimated future prospects. Both qualitative data and quantitative data are considered.

Historical trends and current conditions, in addition to prepared projections, are utilized when making evaluations

about future performance. Evaluations are generally based on what has taken place over the last five to ten

years.

When applying for a credit rating, the items required of the City include audit reports, current budget documents,

current capital improvement program, statements of long and short-term debt, and an indication of appropriate

authority for debt issuance. Standard & Poor’s ratings range from AAA to BBB, with AAA being the highest rating.

Moody’s has nine basic rating categories for long-term obligations, ranging from AAA to C. An AAA rating

indicates the issuer has an extremely strong ability to meet its debt obligations, whereas a C rating represents

an adequate ability to meet debt requirements.

Financial Advisor – The City currently uses Hilltop Securities, Inc. in the capacity of financial advisor. Hilltop

Securities, Inc. coordinates all the debt issuances for the City. They assist in the determination of the City’s

capacity to authorize, issue, and service debt. On the basis of this determination and with the approval of the

City, Hilltop Securities, Inc. proceeds with the sale of any debt instruments. Furthermore, after the City accepts

a bid for any debt instruments, Hilltop Securities, Inc. directs the closing of the sale.

Debt Capacity – As of October 1, 2020, the City currently has capacity to issue approximately $42 million in tax-

supported debt over the next five years. The following assumptions were made in determining the City’s debt

capacity: no change in taxable value through either the appreciation of property or through the addition of new

construction, a constant interest and sinking (I&S) tax rate of $0.232089, the continued retirement of the City’s

existing debt in accordance with its debt service schedules, an estimated interest rate of 2.1% to 5.0% for future

debt, new debt being amortized over 20 years with an level principal debt service structure, and the City

maintaining its current bond rating. This capacity will be utilized to support the City’s 2020 Bond program

approved as part of the November 2020 bond election.

DEBT SERVICE FUND SUMMARY

Below is a summary of each of the City’s outstanding obligations. Please note the figures in parentheses

represent the remaining principal amount for each issue.

GENERAL DEBT (Series 2005-2020)

Certificates of Obligation, 2021 – A future debt issuance of approximately $1,145,000 is planned for 2021 to

include approximately $305,000 for the replacement of a truck and jetter.

346