Page 75 - Manfield FY21 Budget

P. 75

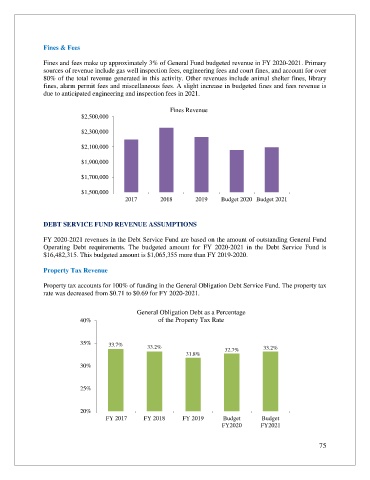

Fines & Fees

Fines and fees make up approximately 3% of General Fund budgeted revenue in FY 2020-2021. Primary

sources of revenue include gas well inspection fees, engineering fees and court fines, and account for over

80% of the total revenue generated in this activity. Other revenues include animal shelter fines, library

fines, alarm permit fees and miscellaneous fees. A slight increase in budgeted fines and fees revenue is

due to anticipated engineering and inspection fees in 2021.

Fines Revenue

$2,500,000

$2,300,000

$2,100,000

$1,900,000

$1,700,000

$1,500,000

2017 2018 2019 Budget 2020 Budget 2021

DEBT SERVICE FUND REVENUE ASSUMPTIONS

FY 2020-2021 revenues in the Debt Service Fund are based on the amount of outstanding General Fund

Operating Debt requirements. The budgeted amount for FY 2020-2021 in the Debt Service Fund is

$16,482,315. This budgeted amount is $1,065,355 more than FY 2019-2020.

Property Tax Revenue

Property tax accounts for 100% of funding in the General Obligation Debt Service Fund. The property tax

rate was decreased from $0.71 to $0.69 for FY 2020-2021.

General Obligation Debt as a Percentage

40% of the Property Tax Rate

35% 33.7% 33.2% 33.2%

31.8% 32.7%

30%

25%

20%

FY 2017 FY 2018 FY 2019 Budget Budget

FY2020 FY2021

75