Page 9 - Kennedale Budget FY21

P. 9

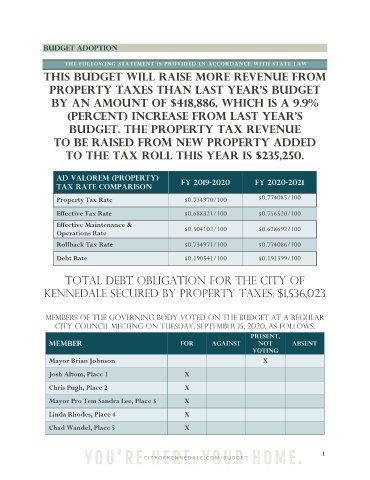

BUDGET ADOPTION

THE FOLLOWING STATEMENT IS PROVID ED IN ACCORDANCE WITH STATE LAW

THIS BUDGET WILL RAISE MORE REVENUE FROM

PROPERTY TAXES THAN LAST YEAR'S BUDGET

BY AN AMOUNT OF $418,886, WHICH IS A 9.9%

(PERCENT) INCREASE FROM LAST YEAR'S

BUDGET. THE PROPERTY TAX REVENUE

TO BE RAISED FROM NEW PROPERTY ADDED

TO THE TAX ROLL THIS YEAR IS $235,250.

AD VALOREM (PROPERTY) FY 2019-2020 FY 2020-2021

Tax RATE COMPARISON

Property Tax Rate $0.734970/100 $0.774085/100

Effective Tax Rate $0.688321/100 $0.756520/100

Effective Maintenance & $0.504102/100 $0.628692/100

Operations Rate

Rollback Tax Rate $0.734971/100 $0.774086/100

Debt Rate $0.190541/100 $0.191399/100

TOTAL DEBT OBLIGATION FOR the CITY OF

KENNEDALE SECURED BY PROPERTY TAXES: $1,536,023

MEMBERS OF THE GOVERNING BODY VOTED ON THE BUDGET AT A REGULAR

CITY COUNCIL MEETING ON TUESDAY, SEPTEMBER 15, 2020, AS FOLLOWS:

PRESENT,

MEMBER FOR AGAINST NOT ABSENT

VOTING

Mayor Brian Johnson X

Josh Altom, Place 1 X

Chris Pugh, Place 2 X

Mayor Pro Tem Sandra Lee, Place 3 X

Linda Rhodes, Place 4 X

Chad Wandel, Place 5 X

1