Page 23 - Kennedale Budget FY21

P. 23

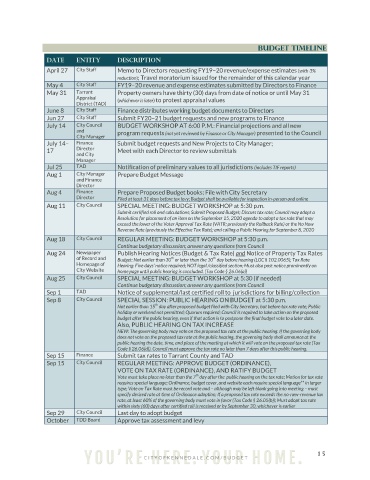

BUDGET TIMELINE

DATE ENTITY DESCRIPTION

April 27 City Staff Memo to Directors requesting FY19–20 revenue/expense estimates (with 3%

reduction); Travel moratorium issued for the remainder of this calendar year

May 4 City Staff FY19–20 revenue and expense estimates submitted by Directors to Finance

May 31 Tarrant Property owners have thirty (30) days from date of notice or until May 31

Appraisal (whichever is later) to protest appraisal values

District (TAD)

June 8 City Staff Finance distributes working budget documents to Directors

Jun 27 City Staff Submit FY20–21 budget requests and new programs to Finance

July 14 City Council BUDGET WORKSHOP AT 6:00 P.M.: Financial projections and all new

and program requests (not yet reviewed by Finance or City Manager) presented to the Council

City Manager

July 14– Finance Submit budget requests and New Projects to City Manager;

17 Director Meet with each Director to review submittals

and City

Manager

Jul 25 TAD Notification of preliminary values to all jurisdictions (includes TIF reports)

Aug 1 City Manager Prepare Budget Message

and Finance

Director

Aug 4 Finance Prepare Proposed Budget books; File with City Secretary

Director Filed at least 31 days before tax levy; Budget shall be available for inspection in-person and online

Aug 11 City Council SPECIAL MEETING: BUDGET WORKSHOP at 5:30 p.m.

Submit certified roll and calculations; Submit Proposed Budget; Discuss tax rate; Council may adopt a

Resolution for placement of an item on the September 15, 2020 agenda to adopt a tax rate that may

exceed the lower of the Voter Approval Tax Rate (VATR; previously the Rollback Rate) or the No New

Revenue Rate (previously the Effective Tax Rate); and calling a Public Hearing for September 8, 2020

Aug 18 City Council REGULAR MEETING: BUDGET WORKSHOP at 5:30 p.m.

Continue budgetary discussion; answer any questions from Council

Aug 24 Newspaper Publish Hearing Notices (Budget & Tax Rate) and Notice of Property Tax Rates

of Record and Budget: Not earlier than 30 or later than the 10 day before hearing (LGC § 102.0065); Tax Rate

th

th

Homepage of Hearing: Five days’ notice required; NOT legal /classified section; Must also post notice prominently on

City Website home page until public hearing is concluded. (Tax Code § 26.06(a))

Aug 25 City Council SPECIAL MEETING: BUDGET WORKSHOP at 5:30 (if needed)

Continue budgetary discussion; answer any questions from Council

Sep 1 TAD Notice of supplemental/last certified roll to jurisdictions for billing/collection

Sep 8 City Council SPECIAL SESSION: PUBLIC HEARING ON BUDGET at 5:30 p.m.

th

Not earlier than 15 day after proposed budget filed with City Secretary, but before tax rate vote; Public

holiday or weekend not permitted; Quorum required; Council is required to take action on the proposed

budget after the public hearing, even if that action is to postpone the final budget vote to a later date.

Also, PUBLIC HEARING ON TAX INCREASE

NEW: The governing body may vote on the proposed tax rate at the public hearing. If the governing body

does not vote on the proposed tax rate at the public hearing, the governing body shall announce at the

public hearing the date, time, and place of the meeting at which it will vote on the proposed tax rate (Tax

Code § 26.06(d)). Council must approve the tax rate no later than 7 days after this public hearing.

Sep 15 Finance Submit tax rates to Tarrant County and TAD

Sep 15 City Council REGULAR MEETING: APPROVE BUDGET (ORDINANCE),

VOTE ON TAX RATE (ORDINANCE), AND RATIFY BUDGET

th

Vote must take place no later than the 7 day after the public hearing on the tax rate; Motion for tax rate

requires special language; Ordinance, budget cover, and website each require special language** in larger

type; Vote on Tax Rate must be record vote and – although may be left blank going into meeting – must

specify desired rate at time of Ordinance adoption; If a proposed tax rate exceeds the no-new-revenue tax

rate, at least 60% of the governing body must vote in favor (Tax Code § 26.05(b)); Must adopt tax rate

within sixty (60) days after certified roll is received or by September 30, whichever is earlier

Sep 29 City Council Last day to adopt budget

October TDD Board Approve tax assessment and levy

1 5