Page 312 - Hurst Budget FY21

P. 312

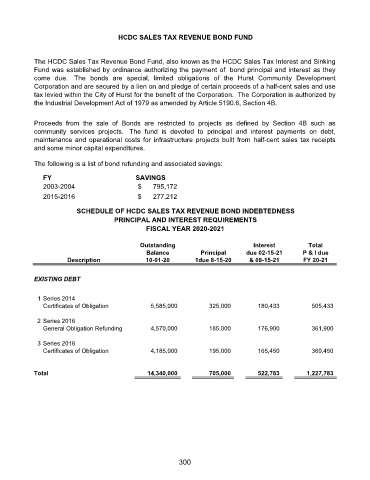

HCDC SALES TAX REVENUE BOND FUND

The HCDC Sales Tax Revenue Bond Fund, also known as the HCDC Sales Tax Interest and Sinking

Fund was established by ordinance authorizing the payment of bond principal and interest as they

come due. The bonds are special, limited obligations of the Hurst Community Development

Corporation and are secured by a lien on and pledge of certain proceeds of a half-cent sales and use

tax levied within the City of Hurst for the benefit of the Corporation. The Corporation is authorized by

the Industrial Development Act of 1979 as amended by Article 5190.6, Section 4B.

Proceeds from the sale of Bonds are restricted to projects as defined by Section 4B such as

community services projects. The fund is devoted to principal and interest payments on debt,

maintenance and operational costs for infrastructure projects built from half-cent sales tax receipts

and some minor capital expenditures.

The following is a list of bond refunding and associated savings:

FY SAVINGS

2003-2004 $ 795,172

2015-2016 $ 277,212

SCHEDULE OF HCDC SALES TAX REVENUE BOND INDEBTEDNESS

PRINCIPAL AND INTEREST REQUIREMENTS

FISCAL YEAR 2020-2021

Outstanding Interest Total

Balance Principal due 02-15-21 P & I due

Description 10-01-20 1due 8-15-20 & 08-15-21 FY 20-21

EXISTING DEBT

1 Series 2014

Certificates of Obligation 5,585,000 325,000 180,433 505,433

2 Series 2016

General Obligation Refunding 4,570,000 185,000 176,900 361,900

3 Series 2016

Certificates of Obligation 4,185,000 195,000 165,450 360,450

Total 14,340,000 705,000 522,783 1,227,783

300