Page 15 - Hurst Budget FY21

P. 15

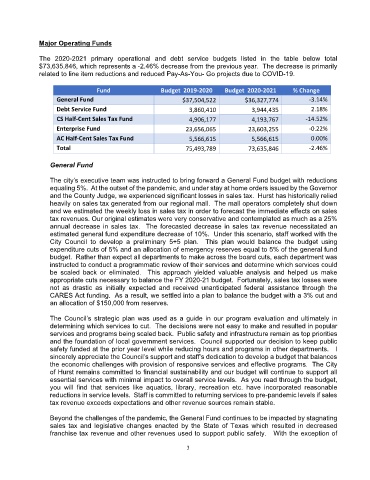

Major Operating Funds

The 2020-2021 primary operational and debt service budgets listed in the table below total

$73,635,846, which represents a -2.46% decrease from the previous year. The decrease is primarily

related to line item reductions and reduced Pay-As-You- Go projects due to COVID-19.

Fund Budget 2019‐2020 Budget 2020‐2021 % Change

General Fund $37,504,522 $36,327,774 ‐3.14%

Debt Service Fund 3,860,410 3,944,435 2.18%

CS Half‐Cent Sales Tax Fund 4,906,177 4,193,767 ‐14.52%

Enterprise Fund 23,656,065 23,603,255 ‐0.22%

AC Half‐Cent Sales Tax Fund 5,566,615 5,566,615 0.00%

Total 75,493,789 73,635,846 ‐2.46%

General Fund

The city’s executive team was instructed to bring forward a General Fund budget with reductions

equaling 5%. At the outset of the pandemic, and under stay at home orders issued by the Governor

and the County Judge, we experienced significant losses in sales tax. Hurst has historically relied

heavily on sales tax generated from our regional mall. The mall operators completely shut down

and we estimated the weekly loss in sales tax in order to forecast the immediate effects on sales

tax revenues. Our original estimates were very conservative and contemplated as much as a 25%

annual decrease in sales tax. The forecasted decrease in sales tax revenue necessitated an

estimated general fund expenditure decrease of 10%. Under this scenario, staff worked with the

City Council to develop a preliminary 5+5 plan. This plan would balance the budget using

expenditure cuts of 5% and an allocation of emergency reserves equal to 5% of the general fund

budget. Rather than expect all departments to make across the board cuts, each department was

instructed to conduct a programmatic review of their services and determine which services could

be scaled back or eliminated. This approach yielded valuable analysis and helped us make

appropriate cuts necessary to balance the FY 2020-21 budget. Fortunately, sales tax losses were

not as drastic as initially expected and received unanticipated federal assistance through the

CARES Act funding. As a result, we settled into a plan to balance the budget with a 3% cut and

an allocation of $150,000 from reserves.

The Council’s strategic plan was used as a guide in our program evaluation and ultimately in

determining which services to cut. The decisions were not easy to make and resulted in popular

services and programs being scaled back. Public safety and infrastructure remain as top priorities

and the foundation of local government services. Council supported our decision to keep public

safety funded at the prior year level while reducing hours and programs in other departments. I

sincerely appreciate the Council’s support and staff’s dedication to develop a budget that balances

the economic challenges with provision of responsive services and effective programs. The City

of Hurst remains committed to financial sustainability and our budget will continue to support all

essential services with minimal impact to overall service levels. As you read through the budget,

you will find that services like aquatics, library, recreation etc. have incorporated reasonable

reductions in service levels. Staff is committed to returning services to pre-pandemic levels if sales

tax revenue exceeds expectations and other revenue sources remain stable.

Beyond the challenges of the pandemic, the General Fund continues to be impacted by stagnating

sales tax and legislative changes enacted by the State of Texas which resulted in decreased

franchise tax revenue and other revenues used to support public safety. With the exception of

3