Page 258 - Grapevine Budget FY21

P. 258

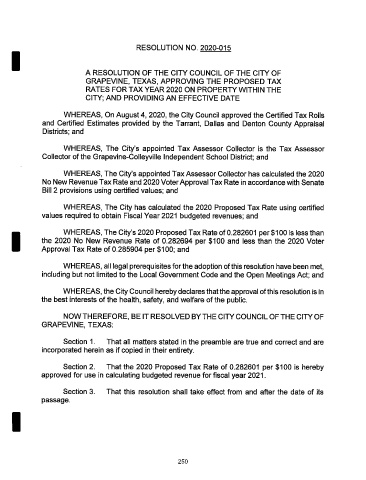

RESOLUTION NO. 2020- 015

A RESOLUTION OF THE CITY COUNCIL OF THE CITY OF

GRAPEVINE, TEXAS, APPROVING THE PROPOSED TAX

RATES FOR TAX YEAR 2020 ON PROPERTY WITHIN THE

CITY; AND PROVIDING AN EFFECTIVE DATE

WHEREAS, On August 4, 2020, the City Council approved the Certified Tax Rolls

and Certified Estimates provided by the Tarrant, Dallas and Denton County Appraisal

Districts; and

WHEREAS, The City's appointed Tax Assessor Collector is the Tax Assessor

Collector of the Grapevine- Colleyville Independent School District; and

WHEREAS, The City's appointed Tax Assessor Collector has calculated the 2020

No New Revenue Tax Rate and 2020 VoterApproval Tax Rate in accordance with Senate

Bill 2 provisions using certified values; and

WHEREAS, The City has calculated the 2020 Proposed Tax Rate using certified

values required to obtain Fiscal Year 2021 budgeted revenues; and

WHEREAS, The City' s 2020 Proposed Tax Rate of 0. 282601 per$ 100 is less than

the 2020 No New Revenue Rate of 0. 282694 per $ 100 and less than the 2020 Voter

Approval Tax Rate of 0. 285904 per $ 100; and

WHEREAS, all legal prerequisites forthe adoption ofthis resolution have been met,

including but not limited to the Local Government Code and the Open Meetings Act; and

WHEREAS, the City Council hereby declares that the approval ofthis resolution is in

the best interests of the health, safety, and welfare of the public.

NOW THEREFORE, BE IT RESOLVED BY THE CITY COUNCIL OF THE CITY OF

GRAPEVINE, TEXAS:

Section 1. That all matters stated in the preamble are true and correct and are

incorporated herein as if copied in their entirety.

Section 2. That the 2020 Proposed Tax Rate of 0. 282601 per $ 100 is hereby

approved for use in calculating budgeted revenue for fiscal year 2021.

Section 3. That this resolution shall take effect from and after the date of its

passage.

250