Page 239 - Grapevine Budget FY21

P. 239

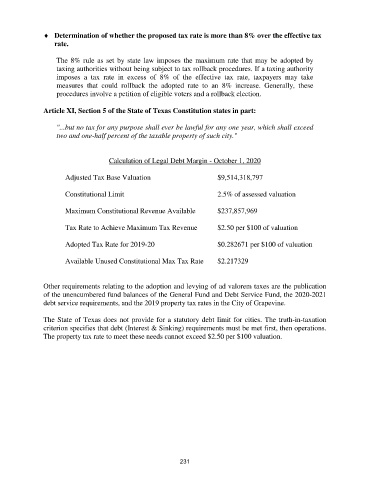

♦ Determination of whether the proposed tax rate is more than 8% over the effective tax

rate.

The 8% rule as set by state law imposes the maximum rate that may be adopted by

taxing authorities without being subject to tax rollback procedures. If a taxing authority

imposes a tax rate in excess of 8% of the effective tax rate, taxpayers may take

measures that could rollback the adopted rate to an 8% increase. Generally, these

procedures involve a petition of eligible voters and a rollback election.

Article XI, Section 5 of the State of Texas Constitution states in part:

"...but no tax for any purpose shall ever be lawful for any one year, which shall exceed

two and one-half percent of the taxable property of such city."

Calculation of Legal Debt Margin - October 1, 2020

Adjusted Tax Base Valuation $9,514,318,797

Constitutional Limit 2.5% of assessed valuation

Maximum Constitutional Revenue Available $237,857,969

Tax Rate to Achieve Maximum Tax Revenue $2.50 per $100 of valuation

Adopted Tax Rate for 2019-20 $0.282671 per $100 of valuation

Available Unused Constitutional Max Tax Rate $2.217329

Other requirements relating to the adoption and levying of ad valorem taxes are the publication

of the unencumbered fund balances of the General Fund and Debt Service Fund, the 2020-2021

debt service requirements, and the 2019 property tax rates in the City of Grapevine.

The State of Texas does not provide for a statutory debt limit for cities. The truth-in-taxation

criterion specifies that debt (Interest & Sinking) requirements must be met first, then operations.

The property tax rate to meet these needs cannot exceed $2.50 per $100 valuation.

231