Page 107 - Forest Hill FY21 Annual Budget

P. 107

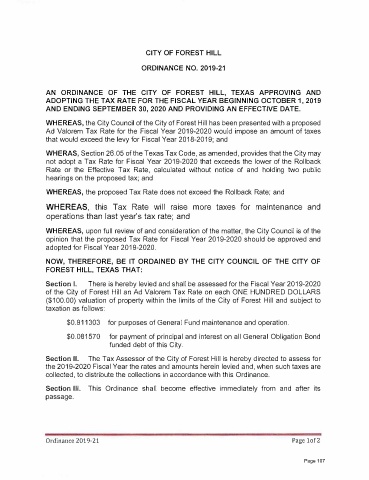

CITY OF FOREST HILL

ORDINANCE NO. 2019-21

AN ORDINANCE OF THE CITY OF FOREST HILL, TEXAS APPROVING AND

ADOPTING THE TAX RATE FOR THE FISCAL YEAR BEGINNING OCTOBER 1, 2019

AND ENDING SEPTEMBER 30, 2020 AND PROVIDING AN EFFECTIVE DATE.

WHEREAS, the City Council of the City of Forest Hill has been presented with a proposed

Ad Valorem Tax Rate for the Fiscal Year 2019-2020 would impose an amount of taxes

that would exceed the levy for Fiscal Year 2018-2019; and

WHERAS, Section 26.05 of the Texas Tax Code, as amended, provides that the City may

not adopt a Tax Rate for Fiscal Year 2019-2020 that exceeds the lower of the Rollback

Rate or the Effective Tax Rate, calculated without notice of and holding two public

hearings on the proposed tax; and

WHEREAS, the proposed Tax Rate does not exceed the Rollback Rate; and

WHEREAS, this Tax Rate will raise more taxes for maintenance and

operations than last year's tax rate; and

WHEREAS, upon full review of and consideration of the matter, the City Council is of the

opinion that the proposed Tax Rate for Fiscal Year 2019-2020 should be approved and

adopted for Fiscal Year 2019-2020.

NOW, THEREFORE, BE IT ORDAINED BY THE CITY COUNCIL OF THE CITY OF

FOREST HILL, TEXAS THAT:

Section I. There is hereby levied and shall be assessed for the Fiscal Year 2019-2020

of the City of Forest Hill an Ad Valorem Tax Rate on each ONE HUNDRED DOLLARS

($100.00) valuation of property within the limits of the City of Forest Hill and subject to

taxation as follows:

$0.911303 for purposes of General Fund maintenance and operation.

$0.081570 for payment of principal and interest on all General Obligation Bond

funded debt of this City.

Section II. The Tax Assessor of the City of Forest Hill is hereby directed to assess for

the 2019-2020 Fiscal Year the rates and amounts herein levied and, when such taxes are

collected, to distribute the collections in accordance with this Ordinance.

Section Ill. This Ordinance shall become effective immediately from and after its

passage.

Ordinance 2019-21 Page lof2

Page 107