Page 300 - Colleyville FY21 Budget

P. 300

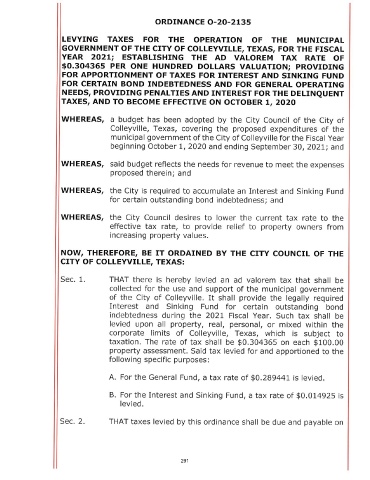

ORDINANCE 0- 20- 2135

LEVYING TAXES FOR THE OPERATION OF THE MUNICIPAL

GOVERNMENT OF THE CITY OF COLLEYVILLE, TEXAS, FOR THE FISCAL

YEAR 2021; ESTABLISHING THE AD VALOREM TAX RATE OF

0. 304365 PER ONE HUNDRED DOLLARS VALUATION; PROVIDING

FOR APPORTIONMENT OF TAXES FOR INTEREST AND SINKING FUND

FOR CERTAIN BOND INDEBTEDNESS AND FOR GENERAL OPERATING

NEEDS, PROVIDING PENALTIES AND INTEREST FOR THE DELINQUENT

TAXES, AND TO BECOME EFFECTIVE ON OCTOBER 1, 2020

WHEREAS, a budget has been adopted by the City Council of the City of

Colleyville, Texas, covering the proposed expenditures of the

municipal government of the City of Colleyville for the Fiscal Year

beginning October 1, 2020 and ending September 30, 2021; and

WHEREAS, said budget reflects the needs for revenue to meet the expenses

proposed therein; and

WHEREAS, the City is required to accumulate an Interest and Sinking Fund

for certain outstanding bond indebtedness; and

WHEREAS, the City Council desires to lower the current tax rate to the

effective tax rate, to provide relief to property owners from

increasing property values.

NOW, THEREFORE, BE IT ORDAINED BY THE CITY COUNCIL OF THE

CITY OF COLLEYVILLE, TEXAS:

Sec. 1. THAT there is hereby levied an ad valorem tax that shall be

collected for the use and support of the municipal government

of the City of Colleyville. It shall provide the legally required

Interest and Sinking Fund for certain outstanding bond

indebtedness during the 2021 Fiscal Year. Such tax shall be

levied upon all property, real, personal, or mixed within the

corporate limits of Colleyville, Texas, which is subject to

taxation. The rate of tax shall be $ 0. 304365 on each $ 100. 00

property assessment. Said tax levied for and apportioned to the

following specific purposes:

A. For the General Fund, a tax rate of $ 0. 289441 is levied.

B. For the Interest and Sinking Fund, a tax rate of $ 0. 014925 is

levied.

Sec. 2. THAT taxes levied by this ordinance shall be due and payable on

291