Page 21 - Colleyville FY21 Budget

P. 21

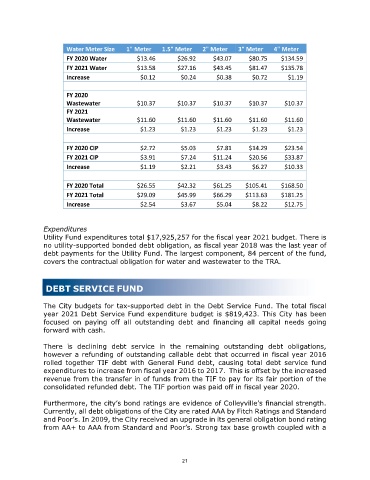

Water Meter Size 1" Meter 1.5" Meter 2" Meter 3" Meter 4" Meter

FY 2020 Water $13.46 $26.92 $43.07 $80.75 $134.59

FY 2021 Water $13.58 $27.16 $43.45 $81.47 $135.78

Increase $0.12 $0.24 $0.38 $0.72 $1.19

FY 2020

Wastewater $10.37 $10.37 $10.37 $10.37 $10.37

FY 2021

Wastewater $11.60 $11.60 $11.60 $11.60 $11.60

Increase $1.23 $1.23 $1.23 $1.23 $1.23

FY 2020 CIP $2.72 $5.03 $7.81 $14.29 $23.54

FY 2021 CIP $3.91 $7.24 $11.24 $20.56 $33.87

Increase $1.19 $2.21 $3.43 $6.27 $10.33

FY 2020 Total $26.55 $42.32 $61.25 $105.41 $168.50

FY 2021 Total $29.09 $45.99 $66.29 $113.63 $181.25

Increase $2.54 $3.67 $5.04 $8.22 $12.75

Expenditures

Utility Fund expenditures total $17,925,257 for the fiscal year 2021 budget. There is

no utility-supported bonded debt obligation, as fiscal year 2018 was the last year of

debt payments for the Utility Fund. The largest component, 84 percent of the fund,

covers the contractual obligation for water and wastewater to the TRA.

DEBT SERVICE FUND

The City budgets for tax-supported debt in the Debt Service Fund. The total fiscal

year 2021 Debt Service Fund expenditure budget is $819,423. This City has been

focused on paying off all outstanding debt and financing all capital needs going

forward with cash.

There is declining debt service in the remaining outstanding debt obligations,

however a refunding of outstanding callable debt that occurred in fiscal year 2016

rolled together TIF debt with General Fund debt, causing total debt service fund

expenditures to increase from fiscal year 2016 to 2017. This is offset by the increased

revenue from the transfer in of funds from the TIF to pay for its fair portion of the

consolidated refunded debt. The TIF portion was paid off in fiscal year 2020.

Furthermore, the city’s bond ratings are evidence of Colleyville’s financial strength.

Currently, all debt obligations of the City are rated AAA by Fitch Ratings and Standard

and Poor’s. In 2009, the City received an upgrade in its general obligation bond rating

from AA+ to AAA from Standard and Poor’s. Strong tax base growth coupled with a

21