Page 89 - Benbrook FY2021

P. 89

In 2005, the City issued $2,500,000 in certificates of obligation to finance projects and expenses related to the Tax Increment Financing (TIF)

District. In 2012, the City of Benbrook sold $1,280,000 in certificates of obligation for TIF projects; these costs are included in the TIF Fund for

2016-17 and future years. The TIF is required to repay these expenses to the City when funds are available. In June 2014, the City issued

certificates of obligation for the TIF. A transfer is made from the TIF Fund to the Debt Service Fund to pay for the TIF related debt.

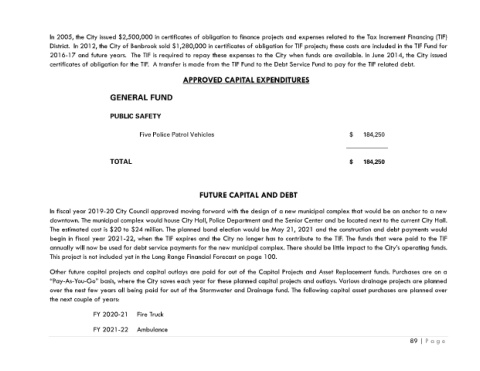

APPROVED CAPITAL EXPENDITURES

GENERAL FUND

PUBLIC SAFETY

Five Police Patrol Vehicles $ 184,250

TOTAL $ 184,250

FUTURE CAPITAL AND DEBT

In fiscal year 2019-20 City Council approved moving forward with the design of a new municipal complex that would be an anchor to a new

downtown. The municipal complex would house City Hall, Police Department and the Senior Center and be located next to the current City Hall.

The estimated cost is $20 to $24 million. The planned bond election would be May 21, 2021 and the construction and debt payments would

begin in fiscal year 2021-22, when the TIF expires and the City no longer has to contribute to the TIF. The funds that were paid to the TIF

annually will now be used for debt service payments for the new municipal complex. There should be little impact to the City’s operating funds.

This project is not included yet in the Long Range Financial Forecast on page 100.

Other future capital projects and capital outlays are paid for out of the Capital Projects and Asset Replacement funds. Purchases are on a

“Pay-As-You-Go” basis, where the City saves each year for these planned capital projects and outlays. Various drainage projects are planned

over the nest few years all being paid for out of the Stormwater and Drainage fund. The following capital asset purchases are planned over

the next couple of years:

FY 2020-21 Fire Truck

FY 2021-22 Ambulance

89 | P a g e