Page 301 - Benbrook FY2021

P. 301

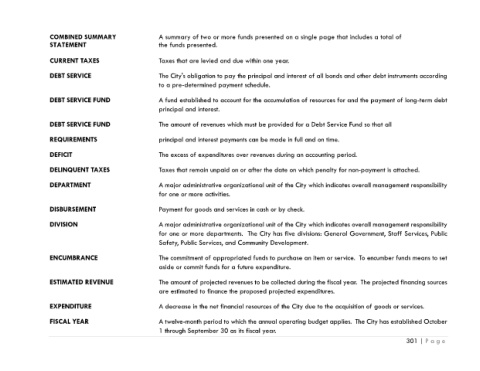

COMBINED SUMMARY A summary of two or more funds presented on a single page that includes a total of

STATEMENT the funds presented.

CURRENT TAXES Taxes that are levied and due within one year.

DEBT SERVICE The City's obligation to pay the principal and interest of all bonds and other debt instruments according

to a pre-determined payment schedule.

DEBT SERVICE FUND A fund established to account for the accumulation of resources for and the payment of long-term debt

principal and interest.

DEBT SERVICE FUND The amount of revenues which must be provided for a Debt Service Fund so that all

REQUIREMENTS principal and interest payments can be made in full and on time.

DEFICIT The excess of expenditures over revenues during an accounting period.

DELINQUENT TAXES Taxes that remain unpaid on or after the date on which penalty for non-payment is attached.

DEPARTMENT A major administrative organizational unit of the City which indicates overall management responsibility

for one or more activities.

DISBURSEMENT Payment for goods and services in cash or by check.

DIVISION A major administrative organizational unit of the City which indicates overall management responsibility

for one or more departments. The City has five divisions: General Government, Staff Services, Public

Safety, Public Services, and Community Development.

ENCUMBRANCE The commitment of appropriated funds to purchase an item or service. To encumber funds means to set

aside or commit funds for a future expenditure.

ESTIMATED REVENUE The amount of projected revenues to be collected during the fiscal year. The projected financing sources

are estimated to finance the proposed projected expenditures.

EXPENDITURE A decrease in the net financial resources of the City due to the acquisition of goods or services.

FISCAL YEAR A twelve-month period to which the annual operating budget applies. The City has established October

1 through September 30 as its fiscal year.

301 | P a g e