Page 241 - Benbrook FY2021

P. 241

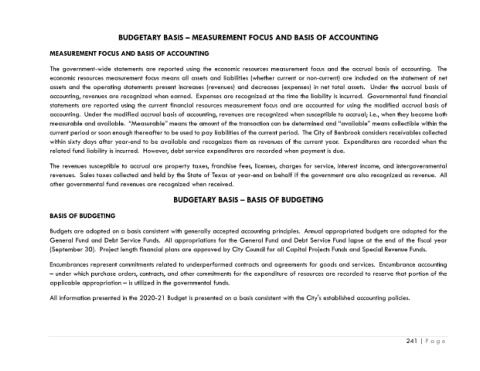

BUDGETARY BASIS – MEASUREMENT FOCUS AND BASIS OF ACCOUNTING

MEASUREMENT FOCUS AND BASIS OF ACCOUNTING

The government-wide statements are reported using the economic resources measurement focus and the accrual basis of accounting. The

economic resources measurement focus means all assets and liabilities (whether current or non-current) are included on the statement of net

assets and the operating statements present increases (revenues) and decreases (expenses) in net total assets. Under the accrual basis of

accounting, revenues are recognized when earned. Expenses are recognized at the time the liability is incurred. Governmental fund financial

statements are reported using the current financial resources measurement focus and are accounted for using the modified accrual basis of

accounting. Under the modified accrual basis of accounting, revenues are recognized when susceptible to accrual; i.e., when they become both

measurable and available. “Measurable” means the amount of the transaction can be determined and “available” means collectible within the

current period or soon enough thereafter to be used to pay liabilities of the current period. The City of Benbrook considers receivables collected

within sixty days after year-end to be available and recognizes them as revenues of the current year. Expenditures are recorded when the

related fund liability is incurred. However, debt service expenditures are recorded when payment is due.

The revenues susceptible to accrual are property taxes, franchise fees, licenses, charges for service, interest income, and intergovernmental

revenues. Sales taxes collected and held by the State of Texas at year-end on behalf if the government are also recognized as revenue. All

other governmental fund revenues are recognized when received.

BUDGETARY BASIS – BASIS OF BUDGETING

BASIS OF BUDGETING

Budgets are adopted on a basis consistent with generally accepted accounting principles. Annual appropriated budgets are adopted for the

General Fund and Debt Service Funds. All appropriations for the General Fund and Debt Service Fund lapse at the end of the fiscal year

(September 30). Project length financial plans are approved by City Council for all Capital Projects Funds and Special Revenue Funds.

Encumbrances represent commitments related to underperformed contracts and agreements for goods and services. Encumbrance accounting

– under which purchase orders, contracts, and other commitments for the expenditure of resources are recorded to reserve that portion of the

applicable appropriation – is utilized in the governmental funds.

All information presented in the 2020-21 Budget is presented on a basis consistent with the City's established accounting policies.

241 | P a g e