Page 434 - City of Bedford FY21 Budget

P. 434

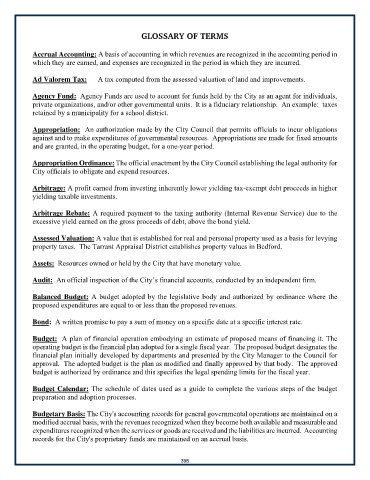

GLOSSARY OF TERMS

Accrual Accounting: A basis of accounting in which revenues are recognized in the accounting period in

which they are earned, and expenses are recognized in the period in which they are incurred.

Ad Valorem Tax: A tax computed from the assessed valuation of land and improvements.

Agency Fund: Agency Funds are used to account for funds held by the City as an agent for individuals,

private organizations, and/or other governmental units. It is a fiduciary relationship. An example: taxes

retained by a municipality for a school district.

Appropriation: An authorization made by the City Council that permits officials to incur obligations

against and to make expenditures of governmental resources. Appropriations are made for fixed amounts

and are granted, in the operating budget, for a one-year period.

Appropriation Ordinance: The official enactment by the City Council establishing the legal authority for

City officials to obligate and expend resources.

Arbitrage: A profit earned from investing inherently lower yielding tax-exempt debt proceeds in higher

yielding taxable investments.

Arbitrage Rebate: A required payment to the taxing authority (Internal Revenue Service) due to the

excessive yield earned on the gross proceeds of debt, above the bond yield.

Assessed Valuation: A value that is established for real and personal property used as a basis for levying

property taxes. The Tarrant Appraisal District establishes property values in Bedford.

Assets: Resources owned or held by the City that have monetary value.

Audit: An official inspection of the City’s financial accounts, conducted by an independent firm.

Balanced Budget: A budget adopted by the legislative body and authorized by ordinance where the

proposed expenditures are equal to or less than the proposed revenues.

Bond: A written promise to pay a sum of money on a specific date at a specific interest rate.

Budget: A plan of financial operation embodying an estimate of proposed means of financing it. The

operating budget is the financial plan adopted for a single fiscal year. The proposed budget designates the

financial plan initially developed by departments and presented by the City Manager to the Council for

approval. The adopted budget is the plan as modified and finally approved by that body. The approved

budget is authorized by ordinance and this specifies the legal spending limits for the fiscal year.

Budget Calendar: The schedule of dates used as a guide to complete the various steps of the budget

preparation and adoption processes.

Budgetary Basis: The City's accounting records for general governmental operations are maintained on a

modified accrual basis, with the revenues recognized when they become both available and measurable and

expenditures recognized when the services or goods are received and the liabilities are incurred. Accounting

records for the City's proprietary funds are maintained on an accrual basis.

398