Page 197 - FY 2020-21 Budget Cover.pub

P. 197

CITY OF AZLE

HOTEL/MOTEL TAX FUND

FY 2020-21

The Hotel/Motel Tax Fund was established by City Ordinance in 1994 under the authority of Chapter

351 of the Texas Tax Code. Revenues are collected from a seven percent tax levied upon the cost of

occupancy of any room or space furnished by a hotel where the cost of occupancy is at the rate of

$2.00 or more per day. This tax is in addition to other occupancy taxes imposed by other government

agencies. However, no taxes were collected in this fund until July 2005 when the first hotel opened in

the City of Azle. The purpose of the tax is to benefit tourism and the hotel industry within the City.

The fund is accounted for on a modified accrual basis of accounting. Revenues are recorded when

available and measurable. Expenditures are recorded when the liability is incurred.

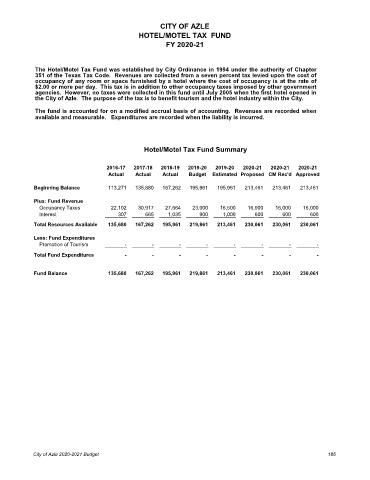

Hotel/Motel Tax Fund Summary

2016-17 2017-18 2018-19 2019-20 2019-20 2020-21 2020-21 2020-21

Actual Actual Actual Budget Estimated Proposed CM Rec'd Approved

Beginning Balance 113,271 135,680 167,262 195,961 195,961 213,461 213,461 213,461

Plus: Fund Revenue

Occupancy Taxes 22,102 30,917 27,664 23,000 16,500 16,000 16,000 16,000

Interest 307 665 1,035 900 1,000 600 600 600

Total Resources Available 135,680 167,262 195,961 219,861 213,461 230,061 230,061 230,061

Less: Fund Expenditures

Promotion of Tourism - - - - - - - -

Total Fund Expenditures - - - - - - - -

Fund Balance 135,680 167,262 195,961 219,861 213,461 230,061 230,061 230,061

City of Azle 2020-2021 Budget 186