Page 61 - City of Westlake FY20 Budget

P. 61

Section 1 Executive

Community Profile

PROPERTY TAX

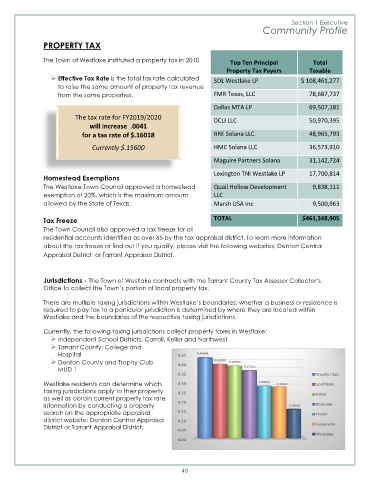

The Town of Westlake instituted a property tax in 2010. Top Ten Principal Total

Property Tax Payers Taxable

Effective Tax Rate is the total tax rate calculated SOL Westlake LP $ 108,461,277

to raise the same amount of property tax revenue

from the same properties. FMR Texas, LLC 78,687,737

Dallas MTA LP 69,507,181

The tax rate for FY2019/2020

will increase .0041 DCLI LLC 50,970,395

for a tax rate of $.16018 BRE Solana LLC 48,965,793

Currently $.15600 HMC Solana LLC 36,573,910

Maguire Partners Solana 31,142,724

Homestead Exemptions Lexington TNI Westlake LP 17,700,814

The Westlake Town Council approved a homestead Quail Hollow Development 9,838,111

exemption of 20%, which is the maximum amount LLC

allowed by the State of Texas. Marsh USA Inc 9,500,963

Tax Freeze TOTAL $461,348,905

The Town Council also approved a tax freeze for all

residential accounts identified as over 65 by the tax appraisal district. To learn more information

about the tax freeze or find out if you qualify, please visit the following websites: Denton Central

Appraisal District or Tarrant Appraisal District.

Jurisdictions - The Town of Westlake contracts with the Tarrant County Tax Assessor Collector’s

Office to collect the Town’s portion of local property tax.

There are multiple taxing jurisdictions within Westlake’s boundaries; whether a business or residence is

required to pay tax to a particular jurisdiction is determined by where they are located within

Westlake and the boundaries of the respective taxing jurisdictions.

Currently, the following taxing jurisdictions collect property taxes in Westlake:

Independent School Districts; Carroll, Keller and Northwest

Tarrant County; College and

Hospital

Denton County and Trophy Club

MUD 1

Westlake residents can determine which

taxing jurisdictions apply to their property

as well as obtain current property tax rate

information by conducting a property

search on the appropriate appraisal

district website: Denton Central Appraisal

District or Tarrant Appraisal District.

49