Page 423 - City of Westlake FY20 Budget

P. 423

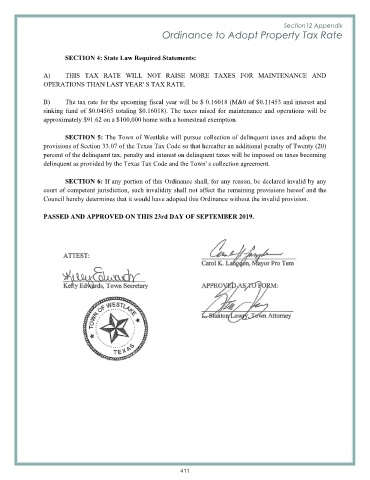

Section12 Appendix

Ordinance to Adopt Property Tax Rate

SECTION 4: State Law Required Statements:

A) THIS TAX RATE WILL NOT RAISE MORE TAXES FOR MAINTENANCE AND

OPERATIONS THAN LAST YEAR' S TAX RATE.

B) The tax rate for the upcoming fiscal year will be $ 0.16018 (M&0 of $0.11453 and interest and

sinking fund of $0.04565 totaling $0.16018). The taxes raised for maintenance and operations will be

approximately $91.62 on a $100,000 home with a homestead exemption.

SECTION 5: The Town of Westlake will pursue collection of delinquent taxes and adopts the

provisions of Section 33.07 of the Texas Tax Code so that hereafter an additional penalty of Twenty (20)

percent of the delinquent tax, penalty and interest on delinquent taxes will be imposed on taxes becoming

delinquent as provided by the Texas Tax Code and the Town' s collection agreement.

SECTION 6: If any portion of this Ordinance shall, for any reason, be declared invalid by any

court of competent jurisdiction, such invalidity shall not affect the remaining provisions hereof and the

Council hereby determines that it would have adopted this Ordinance without the invalid provision.

PASSED AND APPROVED ON THIS 23rd DAY OF SEPTEMBER 2019.

411