Page 315 - City of Westlake FY20 Budget

P. 315

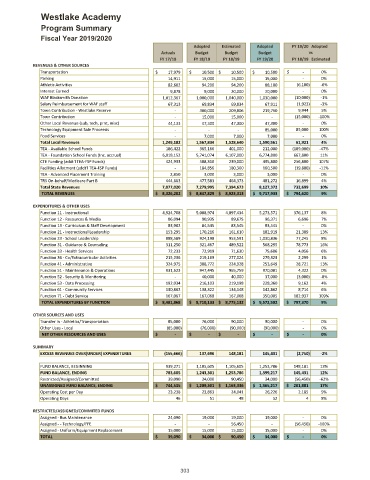

Westlake Academy

Program Summary

Fiscal Year 2019/2020

Adopted Estimated Adopted FY 19/20 Adopted

Actuals Budget Budget Budget vs

FY 17/18 FY 18/19 FY 18/19 FY 19/20 FY 18/19 Estimated

REVENUES & OTHER SOURCES

Transportation $ 17,979 $ 10,500 $ 10,500 $ 10,500 $ ‐ 0%

Parking 14,911 15,000 15,000 15,000 ‐ 0%

Athletic Activities 82,602 94,200 94,200 88,100 (6,100) ‐6%

Interest Earned 9,878 9,000 20,000 20,000 ‐ 0%

WAF Blacksmith Donation 1,012,367 1,000,000 1,040,000 1,030,000 (10,000) ‐1%

Salary Reimbursement for WAF staff 67,313 69,834 69,834 67,911 (1,923) ‐3%

Town Contribution ‐ Westlake Reserve ‐ 300,000 209,806 219,750 9,944 5%

Town Contribution ‐ 15,000 15,000 ‐ (15,000) ‐100%

Other Local Revenue (sub, tech, prnt, misc) 44,133 47,300 47,300 47,300 ‐ 0%

Technology Equipment Sale Proceeds ‐ ‐ ‐ 85,000 85,000 100%

Food Services ‐ 7,000 7,000 7,000 ‐ 0%

Total Local Revenues 1,249,182 1,567,834 1,528,640 1,590,561 61,921 4%

TEA ‐ Available School Funds 186,422 365,166 401,000 212,000 (189,000) ‐47%

TEA ‐ Foundation School Funds (Inc. accrual) 6,018,152 5,741,074 6,107,000 6,774,800 667,800 11%

CTE Funding (addt'l TEA‐FSP Funds) 424,933 508,316 239,000 495,800 256,800 107%

Facilities Allotment (addt'l TEA‐FSP Funds) ‐ 184,856 180,300 160,500 (19,800) ‐11%

TEA ‐ Advanced Placement Training 2,850 3,000 3,000 3,000 ‐ 0%

TRS On‐behalf/Medicare Part B 444,663 477,583 464,373 481,272 16,899 4%

Total State Revenues 7,077,020 7,279,995 7,394,673 8,127,372 732,699 10%

TOTAL REVENUES $ 8,326,202 $ 8,847,829 $ 8,923,313 $ 9,717,933 $ 794,620 9%

EXPENDITURES & OTHER USES

Function 11 ‐ Instructional 4,924,708 5,008,974 4,897,434 5,273,571 376,137 8%

Function 12 ‐ Resources & Media 86,094 90,935 89,675 96,371 6,696 7%

Function 13 ‐ Curriculum & Staff Development 83,902 84,545 83,545 83,545 ‐ 0%

Function 21 ‐ Instructional Leadership 153,295 170,216 161,610 182,919 21,309 13%

Function 23 ‐ School Leadership 888,589 924,198 953,591 1,030,836 77,245 8%

Function 31 ‐ Guidance & Counseling 311,250 321,467 489,522 568,295 78,773 16%

Function 33 ‐ Health Services 72,233 72,919 71,630 75,686 4,056 6%

Function 36 ‐ Co/Extracurricular Activities 215,236 219,169 277,024 279,323 2,299 1%

Function 41 ‐ Administrative 324,975 308,772 224,928 253,649 28,721 13%

Function 51 ‐ Maintenance & Operations 931,623 947,445 965,759 970,081 4,322 0%

Function 52 ‐ Security & Monitoring ‐ 40,000 40,000 37,000 (3,000) ‐8%

Function 53 ‐ Data Processing 192,034 216,103 219,198 228,360 9,162 4%

Function 61 ‐ Community Services 130,862 138,322 134,148 142,862 8,714 6%

Function 71 ‐ Debt Service 167,067 167,068 167,068 350,005 182,937 109%

TOTAL EXPENDITURES BY FUNCTION $ 8,481,868 $ 8,710,133 $ 8,775,132 $ 9,572,502 $ 797,370 9%

OTHER SOURCES AND USES

Transfer in ‐ Athletics/Transportation 85,000 76,000 90,000 90,000 ‐ 0%

Other Uses ‐ Local (85,000) (76,000) (90,000) (90,000) ‐ 0%

NET OTHER RESOURCES AND USES $ ‐ $ ‐ $ ‐ $ ‐ $ ‐ 0%

SUMMARY

EXCESS REVENUES OVER(UNDER) EXPENDITURES (155,666) 137,696 148,181 145,431 (2,750) ‐2%

FUND BALANCE, BEGINNING 939,271 1,105,605 1,105,605 1,253,786 148,181 13%

FUND BALANCE, ENDING 783,605 1,243,301 1,253,786 1,399,217 145,431 12%

Restricted/Assigned/Committed 39,090 34,000 90,450 34,000 (56,450) ‐62%

UNASSIGNED FUND BALANCE, ENDING $ 744,515 $ 1,209,301 $ 1,163,336 $ 1,365,217 $ 201,881 17%

Operating Cost per Day 23,238 23,863 24,041 26,226 2,185 9%

Operating Days 46 51 48 52 4 8%

RESTRICTED/ASSIGNED/COMMITED FUNDS

Assigned ‐ Bus Maintenance 24,090 19,000 19,000 19,000 ‐ 0%

Assigned ‐ ‐ Technology/FFE ‐ ‐ 56,450 ‐ (56,450) ‐100%

Assigned ‐ Uniform/Equipment Replacement 15,000 15,000 15,000 15,000 ‐ 0%

TOTAL $ 39,090 $ 34,000 $ 90,450 $ 34,000 $ ‐ 0%

303