Page 22 - Southlake FY20 Budget

P. 22

Transmittal Letter

ASSESSED VALUE TAXABLE VALUE

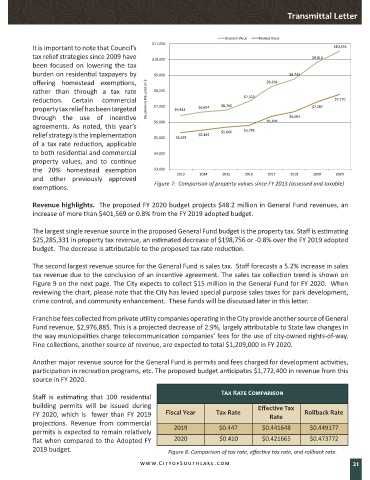

It is important to note that Council’s $11,000 $10,526

tax relief strategies since 2009 have $10,000 $9,810

been focused on lowering the tax

burden on residential taxpayers by $9,000 $8,743

offering homestead exemptions, $8,269

rather than through a tax rate $8,000

reduction. Certain commercial VALUATION IN MILLIONS OF $ $7,323 $7,770

property tax relief has been targeted $7,000 $6,422 $6,654 $6,760 $7,287

through the use of incentive $6,369 $6,662

agreements. As noted, this year’s $6,000 $5,785

relief strategy is the implementation $5,000 $5,331 $5,495 $5,680

of a tax rate reduction, applicable

to both residential and commercial $4,000

property values, and to continue

the 20% homestead exemption $3,000 2013 2014 2015 2016 2017 2018 2019 2020

and other previously approved

exemptions. Figure 7: Comparison of property values since FY 2013 (assessed and taxable)

Revenue highlights. The proposed FY 2020 budget projects $48.2 million in General Fund revenues, an

increase of more than $401,569 or 0.8% from the FY 2019 adopted budget.

The largest single revenue source in the proposed General Fund budget is the property tax. Staff is estimating

$25,285,331 in property tax revenue, an estimated decrease of $198,756 or -0.8% over the FY 2019 adopted

budget. The decrease is attributable to the proposed tax rate reduction.

The second largest revenue source for the General Fund is sales tax. Staff forecasts a 5.2% increase in sales

tax revenue due to the conclusion of an incentive agreement. The sales tax collection trend is shown on

Figure 9 on the next page. The City expects to collect $15 million in the General Fund for FY 2020. When

reviewing the chart, please note that the City has levied special purpose sales taxes for park development,

crime control, and community enhancement. These funds will be discussed later in this letter.

Franchise fees collected from private utility companies operating in the City provide another source of General

Fund revenue, $2,976,885. This is a projected decrease of 2.9%, largely attributable to State law changes in

the way municipalities charge telecommunication companies’ fees for the use of city-owned rights-of-way.

Fine collections, another source of revenue, are expected to total $1,209,000 in FY 2020.

Another major revenue source for the General Fund is permits and fees charged for development activities,

participation in recreation programs, etc. The proposed budget anticipates $1,772,400 in revenue from this

source in FY 2020.

Tax Rate Comparison

Staff is estimating that 100 residential

building permits will be issued during Effective Tax

FY 2020, which is fewer than FY 2019 Fiscal Year Tax Rate Rate Rollback Rate

projections. Revenue from commercial

permits is expected to remain relatively 2019 $0.447 $0.441648 $0.449177

flat when compared to the Adopted FY 2020 $0.410 $0.421665 $0.473772

2019 budget. Figure 8: Comparison of tax rate, effective tax rate, and rollback rate.

www.CityofSouthl ake.com 21