Page 59 - Saginaw FY20 Annual Budget

P. 59

CITY OF SAGINAW

BUDGET DETAIL

2019-2020

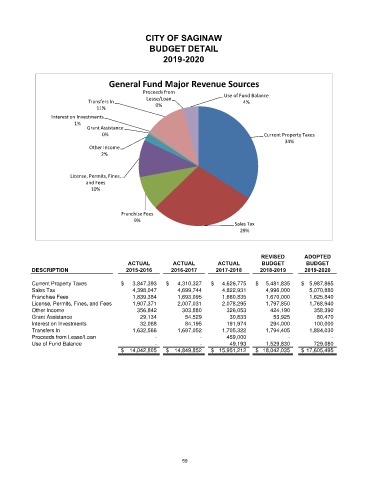

General Fund Major Revenue Sources

Proceeds from Use of Fund Balance

Lease/Loan

Transfers In 4%

0%

11%

Interest on Investments

1%

Grant Assistance

0% Current Property Taxes

34%

Other Income

2%

License, Permits, Fines,

and Fees

10%

Franchise Fees

9%

Sales Tax

29%

REVISED ADOPTED

ACTUAL ACTUAL ACTUAL BUDGET BUDGET

DESCRIPTION 2015-2016 2016-2017 2017-2018 2018-2019 2019-2020

Current Property Taxes $ 3,847,393 $ 4,310,327 $ 4,626,775 $ 5,481,835 $ 5,987,865

Sales Tax 4,398,047 4,699,744 4,822,931 4,996,000 5,070,880

Franchise Fees 1,839,384 1,693,095 1,660,835 1,670,000 1,625,840

License, Permits, Fines, and Fees 1,907,371 2,007,031 2,078,295 1,797,850 1,768,940

Other Income 356,842 303,880 326,053 424,190 358,390

Grant Assistance 29,134 54,529 30,833 53,925 80,470

Interest on Investments 32,068 84,195 191,974 294,000 100,000

Transfers In 1,632,566 1,697,052 1,705,322 1,794,405 1,884,030

Proceeds from Lease/Loan - - 459,000 - -

Use of Fund Balance - - 49,193 1,529,830 729,080

$ 14,042,805 $ 14,849,852 $ 15,951,212 $ 18,042,035 $ 17,605,495

59