Page 240 - Saginaw FY20 Annual Budget

P. 240

CITY OF SAGINAW

DEBT MANAGEMENT POLICY

2019-2020

(continued)

DEBT FINANCING POLICIES

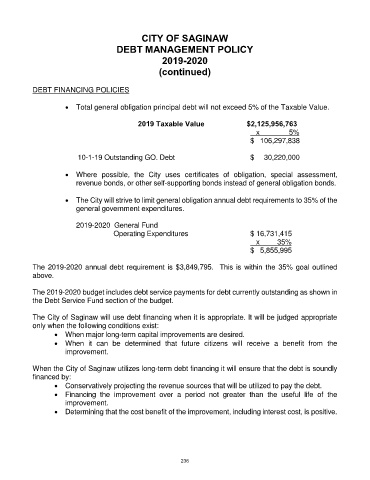

Total general obligation principal debt will not exceed 5% of the Taxable Value.

2019 Taxable Value $2,125,956,763

x 5%

$ 106,297,838

10-1-19 Outstanding GO. Debt $ 30,220,000

Where possible, the City uses certificates of obligation, special assessment,

revenue bonds, or other self-supporting bonds instead of general obligation bonds.

The City will strive to limit general obligation annual debt requirements to 35% of the

general government expenditures.

2019-2020 General Fund

Operating Expenditures $ 16,731,415

x 35%

$ 5,855,995

The 2019-2020 annual debt requirement is $3,849,795. This is within the 35% goal outlined

above.

The 2019-2020 budget includes debt service payments for debt currently outstanding as shown in

the Debt Service Fund section of the budget.

The City of Saginaw will use debt financing when it is appropriate. It will be judged appropriate

only when the following conditions exist:

When major long-term capital improvements are desired.

When it can be determined that future citizens will receive a benefit from the

improvement.

When the City of Saginaw utilizes long-term debt financing it will ensure that the debt is soundly

financed by:

Conservatively projecting the revenue sources that will be utilized to pay the debt.

Financing the improvement over a period not greater than the useful life of the

improvement.

Determining that the cost benefit of the improvement, including interest cost, is positive.

236