Page 2 - Saginaw FY20 Annual Budget

P. 2

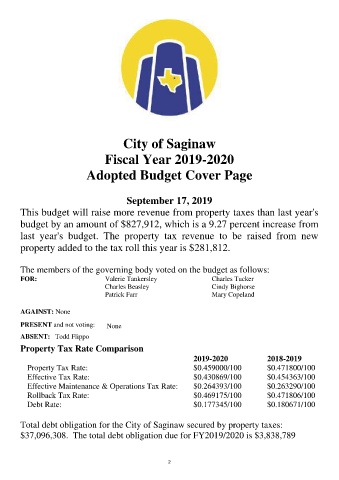

City of Saginaw

Fiscal Year 2019-2020

Adopted Budget Cover Page

September 17, 2019

This budget will raise more revenue from property taxes than last year's

budget by an amount of $827,912, which is a 9.27 percent increase from

last year's budget. The property tax revenue to be raised from new

property added to the tax roll this year is $281,812.

The members of the governing body voted on the budget as follows:

FOR: Valerie Tankersley Charles Tucker

Charles Beasley Cindy Bighorse

Patrick Farr Mary Copeland

AGAINST: None

PRESENT and not voting: None

ABSENT: Todd Flippo

Property Tax Rate Comparison

2019-2020 2018-2019

Property Tax Rate: $0.459000/100 $0.471800/100

Effective Tax Rate: $0.430869/100 $0.454363/100

Effective Maintenance & Operations Tax Rate: $0.264393/100 $0.263290/100

Rollback Tax Rate: $0.469175/100 $0.471806/100

Debt Rate: $0.177345/100 $0.180671/100

Total debt obligation for the City of Saginaw secured by property taxes:

$37,096,308. The total debt obligation due for FY2019/2020 is $3,838,789

2