Page 152 - Saginaw FY20 Annual Budget

P. 152

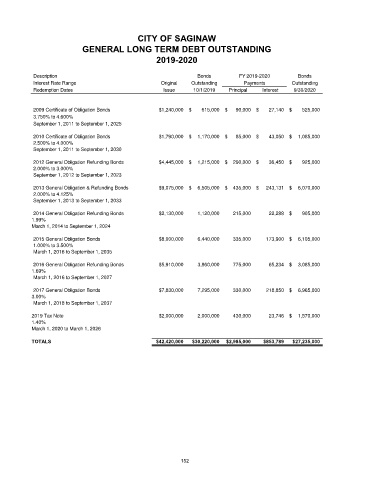

CITY OF SAGINAW

GENERAL LONG TERM DEBT OUTSTANDING

2019-2020

Description Bonds FY 2019-2020 Bonds

Interest Rate Range Original Outstanding Payments Outstanding

Redemption Dates Issue 10/1/2019 Principal Interest 9/30/2020

2009 Certificate of Obligation Bonds $1,240,000 $ 615,000 $ 90,000 $ 27,140 $ 525,000

3.750% to 4.600%

September 1, 2011 to September 1, 2025

2010 Certificate of Obligation Bonds $1,790,000 $ 1,170,000 $ 85,000 $ 43,050 $ 1,085,000

2.500% to 4.000%

September 1, 2011 to September 1, 2030

2012 General Obligation Refunding Bonds $4,445,000 $ 1,215,000 $ 290,000 $ 36,450 $ 925,000

2.000% to 3.000%

September 1, 2012 to September 1, 2023

2013 General Obligation & Refunding Bonds $9,075,000 $ 6,505,000 $ 435,000 $ 243,131 $ 6,070,000

2.000% to 4.125%

September 1, 2013 to September 1, 2033

2014 General Obligation Refunding Bonds $2,130,000 1,120,000 215,000 22,288 $ 905,000

1.99%

March 1, 2014 to September 1, 2024

2015 General Obligation Bonds $8,000,000 6,440,000 335,000 173,900 $ 6,105,000

1.000% to 3.500%

March 1, 2016 to September 1, 2035

2016 General Obligation Refunding Bonds $5,910,000 3,860,000 775,000 65,234 $ 3,085,000

1.69%

March 1, 2016 to September 1, 2027

2017 General Obligation Bonds $7,830,000 7,295,000 330,000 218,850 $ 6,965,000

3.00%

March 1, 2018 to September 1, 2037

2019 Tax Note $2,000,000 2,000,000 430,000 23,746 $ 1,570,000

1.40%

March 1, 2020 to March 1, 2026

TOTALS $42,420,000 $30,220,000 $2,985,000 $853,789 $27,235,000

152