Page 523 - NRH FY20 Approved Budget

P. 523

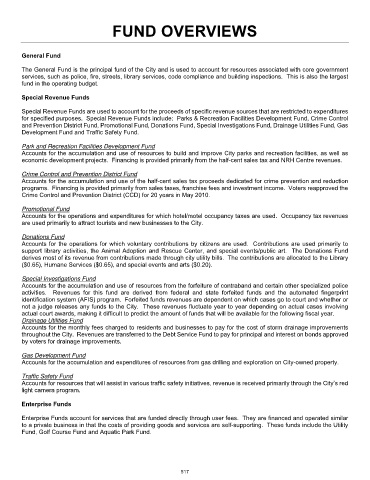

FUND OVERVIEWS

General Fund

The General Fund is the principal fund of the City and is used to account for resources associated with core government

services, such as police, fire, streets, library services, code compliance and building inspections. This is also the largest

fund in the operating budget.

Special Revenue Funds

Special Revenue Funds are used to account for the proceeds of specific revenue sources that are restricted to expenditures

for specified purposes. Special Revenue Funds include: Parks & Recreation Facilities Development Fund, Crime Control

and Prevention District Fund, Promotional Fund, Donations Fund, Special Investigations Fund, Drainage Utilities Fund, Gas

Development Fund and Traffic Safety Fund.

Park and Recreation Facilities Development Fund

Accounts for the accumulation and use of resources to build and improve City parks and recreation facilities, as well as

economic development projects. Financing is provided primarily from the half-cent sales tax and NRH Centre revenues.

Crime Control and Prevention District Fund

Accounts for the accumulation and use of the half-cent sales tax proceeds dedicated for crime prevention and reduction

programs. Financing is provided primarily from sales taxes, franchise fees and investment income. Voters reapproved the

Crime Control and Prevention District (CCD) for 20 years in May 2010.

Promotional Fund

Accounts for the operations and expenditures for which hotel/motel occupancy taxes are used. Occupancy tax revenues

are used primarily to attract tourists and new businesses to the City.

Donations Fund

Accounts for the operations for which voluntary contributions by citizens are used. Contributions are used primarily to

support library activities, the Animal Adoption and Rescue Center, and special events/public art. The Donations Fund

derives most of its revenue from contributions made through city utility bills. The contributions are allocated to the Library

($0.65), Humane Services ($0.65), and special events and arts ($0.20).

Special Investigations Fund

Accounts for the accumulation and use of resources from the forfeiture of contraband and certain other specialized police

activities. Revenues for this fund are derived from federal and state forfeited funds and the automated fingerprint

identification system (AFIS) program. Forfeited funds revenues are dependent on which cases go to court and whether or

not a judge releases any funds to the City. These revenues fluctuate year to year depending on actual cases involving

actual court awards, making it difficult to predict the amount of funds that will be available for the following fiscal year.

Drainage Utilities Fund

Accounts for the monthly fees charged to residents and businesses to pay for the cost of storm drainage improvements

throughout the City. Revenues are transferred to the Debt Service Fund to pay for principal and interest on bonds approved

by voters for drainage improvements.

Gas Development Fund

Accounts for the accumulation and expenditures of resources from gas drilling and exploration on City-owned property.

Traffic Safety Fund

Accounts for resources that will assist in various traffic safety initiatives, revenue is received primarily through the City’s red

light camera program.

Enterprise Funds

Enterprise Funds account for services that are funded directly through user fees. They are financed and operated similar

to a private business in that the costs of providing goods and services are self-supporting. These funds include the Utility

Fund, Golf Course Fund and Aquatic Park Fund.

517