Page 116 - NRH FY20 Approved Budget

P. 116

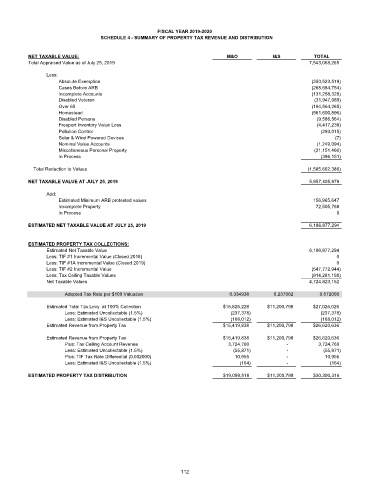

FISCAL YEAR 2019-2020

SCHEDULE 4 - SUMMARY OF PROPERTY TAX REVENUE AND DISTRIBUTION

NET TAXABLE VALUE: M&O I&S TOTAL

Total Appraised Value as of July 25, 2019 7,543,068,265

Less:

Absolute Exemption (350,523,519)

Cases Before ARB (268,684,754)

Incomplete Accounts (131,258,328)

Disabled Veteran (31,947,089)

Over 65 (194,564,265)

Homestead (561,600,896)

Disabled Persons (9,586,564)

Freeport Inventory Value Loss (4,417,238)

Pollution Control (293,015)

Solar & Wind Powered Devices (7)

Nominal Value Accounts (1,249,094)

Miscellaneous Personal Property (31,151,466)

In Process (386,151)

Total Reduction to Values (1,585,662,386)

NET TAXABLE VALUE AT JULY 25, 2019 5,957,405,879

Add:

Estimated Minimum ARB protested values 156,965,647

Incomplete Property 72,505,768

In Process 0

ESTIMATED NET TAXABLE VALUE AT JULY 25, 2019 6,186,877,294

ESTIMATED PROPERTY TAX COLLECTIONS:

Estimated Net Taxable Value 6,186,877,294

Less: TIF #1 Incremental Value (Closed 2018) 0

Less: TIF #1A Incremental Value (Closed 2019) 0

Less: TIF #2 Incremental Value (547,772,944)

Less: Tax Ceiling Taxable Values (914,281,198)

Net Taxable Values 4,724,823,152

Adopted Tax Rate per $100 Valuation 0.334938 0.237062 0.572000

Estimated Total Tax Levy at 100% Collection $15,825,228 $11,200,798 $27,026,026

Less: Estimated Uncollectable (1.5%) (237,378) (237,378)

Less: Estimated I&S Uncollectable (1.5%) (168,012) (168,012)

Estimated Revenue from Property Tax $15,419,838 $11,200,798 $26,620,636

Estimated Revenue from Property Tax $15,419,838 $11,200,798 $26,620,636

Plus: Tax Ceiling Account Revenue 3,724,760 - 3,724,760

Less: Estimated Uncollectable (1.5%) (55,871) - (55,871)

Plus: TIF Tax Rate Differential (0.002000) 10,955 - 10,955

Less: Estimated I&S Uncollectable (1.5%) (164) - (164)

ESTIMATED PROPERTY TAX DISTRIBUTION $19,099,518 $11,200,798 $30,300,316

112