Page 69 - Keller FY20 Approved Budget

P. 69

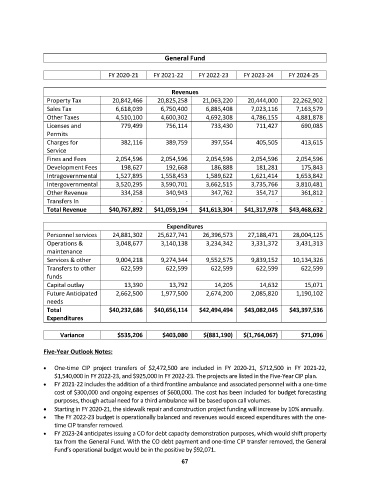

General Fund

FY 2020-21 FY 2021-22 FY 2022-23 FY 2023-24 FY 2024-25

Revenues

Property Tax 20,842,466 20,825,258 21,063,220 20,444,000 22,262,902

Sales Tax 6,618,039 6,750,400 6,885,408 7,023,116 7,163,579

Other Taxes 4,510,100 4,600,302 4,692,308 4,786,155 4,881,878

Licenses and 779,499 756,114 733,430 711,427 690,085

Permits

Charges for 382,116 389,759 397,554 405,505 413,615

Service

Fines and Fees 2,054,596 2,054,596 2,054,596 2,054,596 2,054,596

Development Fees 198,627 192,668 186,888 181,281 175,843

Intragovernmental 1,527,895 1,558,453 1,589,622 1,621,414 1,653,842

Intergovernmental 3,520,295 3,590,701 3,662,515 3,735,766 3,810,481

Other Revenue 334,258 340,943 347,762 354,717 361,812

Transfers In - - - - -

Total Revenue $40,767,892 $41,059,194 $41,613,304 $41,317,978 $43,468,632

Expenditures

Personnel services 24,881,302 25,627,741 26,396,573 27,188,471 28,004,125

Operations & 3,048,677 3,140,138 3,234,342 3,331,372 3,431,313

maintenance

Services & other 9,004,218 9,274,344 9,552,575 9,839,152 10,134,326

Transfers to other 622,599 622,599 622,599 622,599 622,599

funds

Capital outlay 13,390 13,792 14,205 14,632 15,071

Future Anticipated 2,662,500 1,977,500 2,674,200 2,085,820 1,190,102

needs

Total $40,232,686 $40,656,114 $42,494,494 $43,082,045 $43,397,536

Expenditures

Variance $535,206 $403,080 $(881,190) $(1,764,067) $71,096

Five-Year Outlook Notes:

One-time CIP project transfers of $2,472,500 are included in FY 2020-21, $712,500 in FY 2021-22,

$1,540,000 in FY 2022-23, and $925,000 In FY 2022-23. The projects are listed in the Five-Year CIP plan.

FY 2021-22 includes the addition of a third frontline ambulance and associated personnel with a one-time

cost of $300,000 and ongoing expenses of $600,000. The cost has been included for budget forecasting

purposes, though actual need for a third ambulance will be based upon call volumes.

Starting in FY 2020-21, the sidewalk repair and construction project funding will increase by 10% annually.

The FY 2022-23 budget is operationally balanced and revenues would exceed expenditures with the one-

time CIP transfer removed.

FY 2023-24 anticipates issuing a CO for debt capacity demonstration purposes, which would shift property

tax from the General Fund. With the CO debt payment and one-time CIP transfer removed, the General

Fund’s operational budget would be in the positive by $92,071.

67