Page 428 - Keller FY20 Approved Budget

P. 428

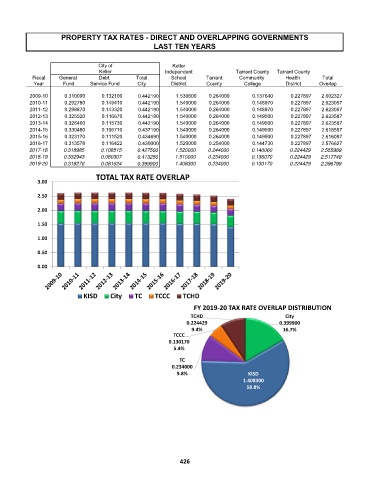

PROPERTY TAX RATES - DIRECT AND OVERLAPPING GOVERNMENTS

LAST TEN YEARS

City of Keller

Keller Independent Tarrant County Tarrant County

Fiscal General Debt Total School Tarrant Community Health Total

Year Fund Service Fund City District County College District Overlap

City KISD TC TCCC TCHD

2009-10 0.310090 0.132100 0.442190 1.530600 0.264000 0.137640 0.227897 2.602327

2010-11 0.292780 0.149410 0.442190 1.540000 0.264000 0.148970 0.227897 2.623057

2011-12 0.298870 0.143320 0.442190 1.540000 0.264000 0.148970 0.227897 2.623057

2012-13 0.325520 0.116670 0.442190 1.540000 0.264000 0.149500 0.227897 2.623587

2013-14 0.326460 0.115730 0.442190 1.540000 0.264000 0.149500 0.227897 2.623587

2014-15 0.330480 0.106710 0.437190 1.540000 0.264000 0.149500 0.227897 2.618587

2015-16 0.323170 0.111520 0.434690 1.540000 0.264000 0.149500 0.227897 2.616087

2016-17 0.313578 0.116422 0.430000 1.520000 0.254000 0.144730 0.227897 2.576627

2017-18 0.318985 0.108515 0.427500 1.520000 0.244000 0.140060 0.224429 2.555989

2018-19 0.332943 0.080307 0.413250 1.510000 0.234000 0.136070 0.224429 2.517749

2019-20 0.318276 0.081624 0.399900 1.408300 0.234000 0.130170 0.224429 2.396799

TOTAL TAX RATE OVERLAP

3.00

2.50

2.00

1.50

1.00

0.50

0.00

KISD City TC TCCC TCHD

FY 2019‐20 TAX RATE OVERLAP DISTRIBUTION

TCHD City

0.224429 0.399900

9.4% 16.7%

TCCC

0.130170

5.4%

TC

0.234000

9.8% KISD

1.408300

58.8%

426