Page 3 - Keller FY20 Approved Budget

P. 3

Filed

Tarrant County Clerk's Office

Mary Louise Nicholson, County Clerk

2021-10-05 3:50:07 PM

As required by Section 102.005 of the Local Government

Code, the City of Keller is providing the following statement

on this cover page of its adopted budget:

This budget will raise more total property taxes than last

year's budget by $427,546 or 1.8%, and of that amount

$527,287 is tax revenue to be raised from new property

added to the tax roll this year.

The members of the governing body voted on the budget adoption as follows:

FOR: Mayor Pat McGrail, Mayor Pro Tem Sean Hicks, Mitch Holmes, Sheri Almond,

Beckie Paquin, Chris Whatley, Tag Green

AGAINST: None

PRESENT and not voting: None

ABSENT: None

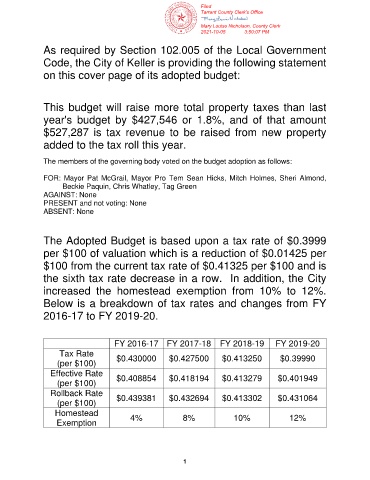

The Adopted Budget is based upon a tax rate of $0.3999

per $100 of valuation which is a reduction of $0.01425 per

$100 from the current tax rate of $0.41325 per $100 and is

the sixth tax rate decrease in a row. In addition, the City

increased the homestead exemption from 10% to 12%.

Below is a breakdown of tax rates and changes from FY

2016-17 to FY 2019-20.

FY 2016-17 FY 2017-18 FY 2018-19 FY 2019-20

Tax Rate

(per $100) $0.430000 $0.427500 $0.413250 $0.39990

Effective Rate $0.408854 $0.418194 $0.413279 $0.401949

(per $100)

Rollback Rate $0.439381 $0.432694 $0.413302 $0.431064

(per $100)

Homestead 4% 8% 10% 12%

Exemption

1