Page 293 - Keller FY20 Approved Budget

P. 293

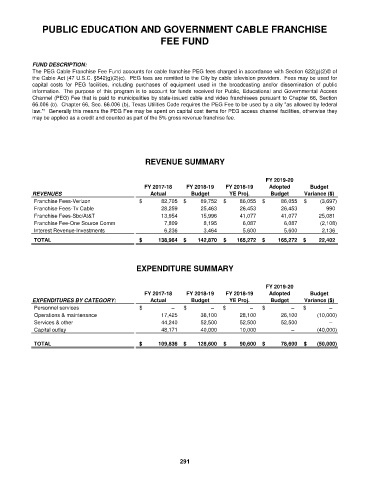

PUBLIC EDUCATION AND GOVERNMENT CABLE FRANCHISE

FEE FUND

FUND DESCRIPTION:

The PEG Cable Franchise Fee Fund accounts for cable franchise PEG fees charged in accordance with Section 622(g)(2)© of

the Cable Act (47 U.S.C. §542(g)(2)(c). PEG fees are remitted to the City by cable television providers. Fees may be used for

capital costs for PEG facilities, including purchases of equipment used in the broadcasting and/or dissemination of public

information. The purpose of this program is to account for funds received for Public, Educational and Governmental Access

Channel (PEG) Fee that is paid to municipalities by state-issued cable and video franchisees pursuant to Chapter 66, Section

66.006 (b). Chapter 66, Sec. 66.006 (b), Texas Utilities Code requires the PEG Fee to be used by a city "as allowed by federal

law."¹ Generally this means the PEG Fee may be spent on capital cost items for PEG access channel facilities, otherwise they

may be applied as a credit and counted as part of the 5% gross revenue franchise fee.

REVENUE SUMMARY

FY 2019-20

FY 2017-18 FY 2018-19 FY 2018-19 Adopted Budget

REVENUES Actual Budget YE Proj. Budget Variance ($)

Franchise Fees-Verizon $ 82,705 $ 89,752 $ 86,055 $ 86,055 $ (3,697)

Franchise Fees-Tv Cable 28,259 25,463 26,453 26,453 990

Franchise Fees-Sbc/At&T 13,954 15,996 41,077 41,077 25,081

Franchise Fee-One Source Comm 7,809 8,195 6,087 6,087 (2,108)

Interest Revenue-Investments 6,236 3,464 5,600 5,600 2,136

TOTAL $ 138,964 $ 142,870 $ 165,272 $ 165,272 $ 22,402

EXPENDITURE SUMMARY

FY 2019-20

FY 2017-18 FY 2018-19 FY 2018-19 Adopted Budget

EXPENDITURES BY CATEGORY: Actual Budget YE Proj. Budget Variance ($)

Personnel services $ – $ – $ – $ – $ –

Operations & maintenance 17,425 36,100 28,100 26,100 (10,000)

Services & other 44,240 52,500 52,500 52,500 –

Capital outlay 48,171 40,000 10,000 – (40,000)

TOTAL $ 109,836 $ 128,600 $ 90,600 $ 78,600 $ (50,000)

291