Page 273 - Keller FY20 Approved Budget

P. 273

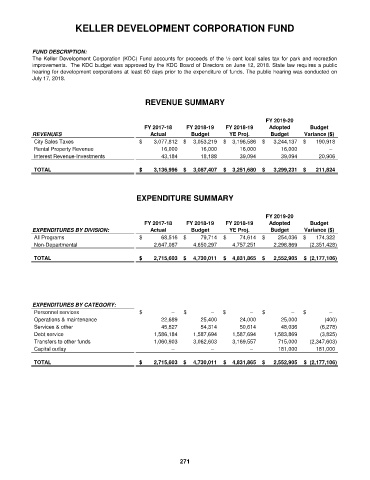

KELLER DEVELOPMENT CORPORATION FUND

FUND DESCRIPTION:

The Keller Development Corporation (KDC) Fund accounts for proceeds of the ½ cent local sales tax for park and recreation

improvements. The KDC budget was approved by the KDC Board of Directors on June 12, 2018. State law requires a public

hearing for development corporations at least 60 days prior to the expenditure of funds. The public hearing was conducted on

July 17, 2018.

REVENUE SUMMARY

FY 2019-20

FY 2017-18 FY 2018-19 FY 2018-19 Adopted Budget

REVENUES Actual Budget YE Proj. Budget Variance ($)

City Sales Taxes $ 3,077,812 $ 3,053,219 $ 3,196,586 $ 3,244,137 $ 190,918

Rental Property Revenue 16,000 16,000 16,000 16,000 –

Interest Revenue-Investments 43,184 18,188 39,094 39,094 20,906

TOTAL $ 3,136,996 $ 3,087,407 $ 3,251,680 $ 3,299,231 $ 211,824

EXPENDITURE SUMMARY

FY 2019-20

FY 2017-18 FY 2018-19 FY 2018-19 Adopted Budget

EXPENDITURES BY DIVISION: Actual Budget YE Proj. Budget Variance ($)

All Programs $ 68,516 $ 79,714 $ 74,614 $ 254,036 $ 174,322

Non-Departmental 2,647,087 4,650,297 4,757,251 2,298,869 (2,351,428)

TOTAL $ 2,715,603 $ 4,730,011 $ 4,831,865 $ 2,552,905 $ (2,177,106)

EXPENDITURES BY CATEGORY:

Personnel services $ – $ – $ – $ – $ –

Operations & maintenance 22,689 25,400 24,000 25,000 (400)

Services & other 45,827 54,314 50,614 48,036 (6,278)

Debt service 1,586,184 1,587,694 1,587,694 1,583,869 (3,825)

Transfers to other funds 1,060,903 3,062,603 3,169,557 715,000 (2,347,603)

Capital outlay – – – 181,000 181,000

TOTAL $ 2,715,603 $ 4,730,011 $ 4,831,865 $ 2,552,905 $ (2,177,106)

271