Page 16 - Keller FY20 Approved Budget

P. 16

September 17, 2019

To the Honorable Mayor McGrail and Members of the City Council

Re: The Annual Budget for Fiscal Year 2019‐20

It is my privilege to present to you the FY 2019‐20 Adopted Budget. This budget represents months of

hard work from your budget team and department directors, and continues our tradition of conservative

fiscal management paired with a commitment to our core values of excellence, integrity, service, creativity

and communication. As always, we remain focused on exploring new opportunities to provide high levels

of service to our citizens in a manner that is both innovative and resourceful.

This budget represents the collective vision of the City Council to maintain municipal services at a level

that delivers excellent quality of life and safety to our citizens while mitigating their property value

increases through lowering the tax rate and raising the homestead exemption.

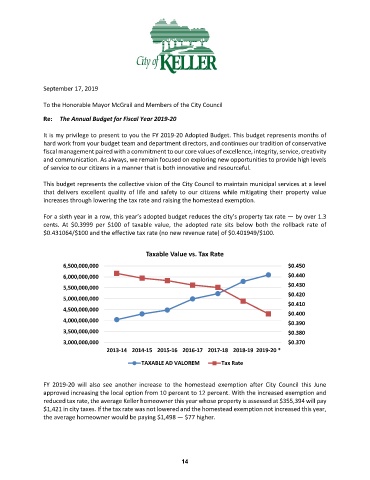

For a sixth year in a row, this year’s adopted budget reduces the city’s property tax rate — by over 1.3

cents. At $0.3999 per $100 of taxable value, the adopted rate sits below both the rollback rate of

$0.431064/$100 and the effective tax rate (no new revenue rate) of $0.401949/$100.

Taxable Value vs. Tax Rate

6,500,000,000 $0.450

6,000,000,000 $0.440

$0.430

5,500,000,000

$0.420

5,000,000,000

$0.410

4,500,000,000

$0.400

4,000,000,000

$0.390

3,500,000,000 $0.380

3,000,000,000 $0.370

2013‐14 2014‐15 2015‐16 2016‐17 2017‐18 2018‐19 2019‐20 *

TAXABLE AD VALOREM Tax Rate

FY 2019‐20 will also see another increase to the homestead exemption after City Council this June

approved increasing the local option from 10 percent to 12 percent. With the increased exemption and

reduced tax rate, the average Keller homeowner this year whose property is assessed at $355,394 will pay

$1,421 in city taxes. If the tax rate was not lowered and the homestead exemption not increased this year,

the average homeowner would be paying $1,498 — $77 higher.

14