Page 251 - Hurst FY20 Approved Budget

P. 251

REVENUE BOND FUND

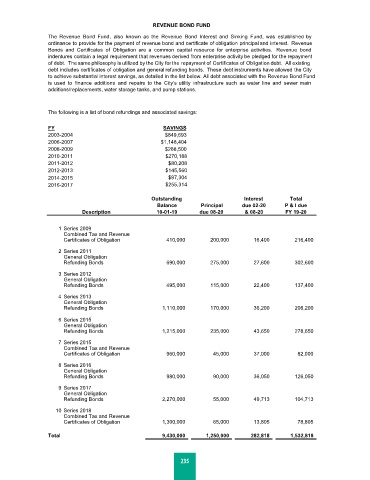

The Revenue Bond Fund, also known as the Revenue Bond Interest and Sinking Fund, was established by

ordinance to provide for the payment of revenue bond and certificate of obligation principal and interest. Revenue

Bonds and Certificates of Obligation are a common capital resource for enterprise activities. Revenue bond

indentures contain a legal requirement that revenues derived from enterprise activity be pledged for the repayment

of debt. The same philosophy is utilized by the City for the repayment of Certificates of Obligation debt. All existing

debt includes certificates of obligation and general refunding bonds. These debt instruments have allowed the City

to achieve substantial interest savings, as detailed in the list below. All debt associated with the Revenue Bond Fund

is used to finance additions and repairs to the City’s utility infrastructure such as water line and sewer main

additions/replacements, water storage tanks, and pump stations.

The following is a list of bond refundings and associated savings:

FY SAVINGS

2003-2004 $849,693

2006-2007 $1,148,404

2008-2009 $288,500

2010-2011 $270,188

2011-2012 $80,208

2012-2013 $145,560

2014-2015 $97,304

2016-2017 $255,314

Outstanding Interest Total

Balance Principal due 02-20 P & I due

Description 10-01-19 due 08-20 & 08-20 FY 19-20

1 Series 2009

Combined Tax and Revenue

Certificates of Obligation 410,000 200,000 16,400 216,400

2 Series 2011

General Obligation

Refunding Bonds 690,000 275,000 27,600 302,600

3 Series 2012

General Obligation

Refunding Bonds 495,000 115,000 22,400 137,400

4 Series 2013

General Obligation

Refunding Bonds 1,110,000 170,000 36,200 206,200

6 Series 2015

General Obligation

Refunding Bonds 1,215,000 235,000 43,650 278,650

7 Series 2015

Combined Tax and Revenue

Certificates of Obligation 960,000 45,000 37,000 82,000

8 Series 2016

General Obligation

Refunding Bonds 980,000 90,000 36,050 126,050

9 Series 2017

General Obligation

Refunding Bonds 2,270,000 55,000 49,713 104,713

10 Series 2018

Combined Tax and Revenue

Certificates of Obligation 1,300,000 65,000 13,805 78,805

Total 9,430,000 1,250,000 282,818 1,532,818

235