Page 18 - Haltom City FY20 Approved Budget

P. 18

City of Haltom City Annual Budget, FY 2020

Introduction

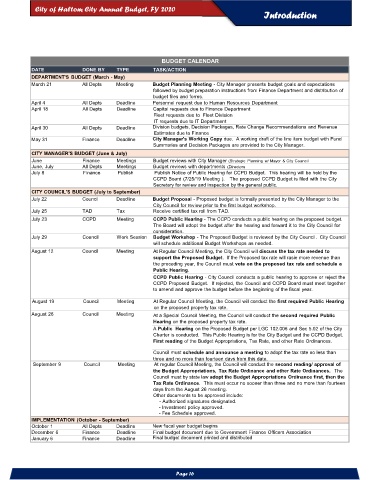

BUDGET CALENDAR

DATE DONE BY TYPE TASK/ACTION

DEPARTMENT'S BUDGET (March - May)

March 21 All Depts Meeting Budget Planning Meeting - City Manager presents budget goals and expectations

followed by budget preparation instructions from Finance Department and distribution of

budget files and forms.

April 4 All Depts Deadline Personnel request due to Human Resources Department

April 18 All Depts Deadline Capital requests due to Finance Department

Fleet requests due to Fleet Division

IT requests due to IT Department

April 30 All Depts Deadline Division budgets, Decision Packages, Rate Change Recommendations and Revenue

Estimates due to Finance

May 31 Finance Deadline City Manager's Working Copy due. A working draft of the line item budget with Fund

Summaries and Decision Packages are provided to the City Manager.

CITY MANAGER'S BUDGET (June & July)

June Finance Meetings Budget reviews with City Manager (Strategic Planning w/ Mayor & City Council

June, July All Depts Meetings Budget reviews with departments (Directors

July 8 Finance Publish Publish Notice of Public Hearing for CCPD Budget. This hearing will be held by the

CCPD Board (7/25/19 Meeting ). The proposed CCPD Budget is filed with the City

Secretary for review and inspection by the general public.

CITY COUNCIL'S BUDGET (July to September)

July 22 Council Deadline Budget Proposal - Proposed budget is formally presented by the City Manager to the

City Council for review prior to the first budget workshop.

July 25 TAD Tax Receive certified tax roll from TAD.

July 23 CCPD Meeting CCPD Public Hearing - The CCPD conducts a public hearing on the proposed budget.

The Board will adopt the budget after the hearing and forward it to the City Council for

consideration.

July 29 Council Work Session Budget Workshop - The Proposed Budget is reviewed by the City Council. City Council

will schedule additional Budget Workshops as needed.

August 12 Council Meeting At Regular Council Meeting, the City Council will discuss the tax rate needed to

support the Proposed Budget. If the Proposed tax rate will rasie more revenue than

the preceding year, the Council must vote on the proposed tax rate and schedule a

Public Hearing.

CCPD Public Hearing - City Council conducts a public hearing to approve or reject the

CCPD Proposed Budget. If rejected, the Council and CCPD Board must meet together

to amend and approve the budget before the beginning of the fiscal year.

August 19 Council Meeting At Regular Council Meeting, the Council will conduct the first required Public Hearing

on the proposed property tax rate.

August 26 Council Meeting At a Special Council Meeting, the Council will conduct the second required Public

Hearing on the proposed property tax rate.

A Public Hearing on the Proposed Budget per LGC 102.006 and Sec 5.02 of the City

Charter is conducted. This Public Hearing is for the City Budget and the CCPD Budget.

First reading of the Budget Appropriations, Tax Rate, and other Rate Ordinances.

Council must schedule and announce a meeting to adopt the tax rate no less than

three and no more than fourteen daysfrom this date.

September 9 Council Meeting At regular Council Meeting, the Council will conduct the second reading/ approval of

the Budget Appropriations, Tax Rate Ordinance and other Rate Ordinances. The

Council must by state law adopt the Budget Appropriations Ordinance first, then the

Tax Rate Ordinance. This must occur no sooner than three and no more than fourteen

days from the August 26 meeting.

Other documents to be approved include:

- Authorized signatures designated.

- Investment policy approved.

- Fee Schedule approved.

IMPLEMENTATION (October - September)

October 1 All Depts Deadline New fiscal year budget begins

December 6 Finance Deadline Final budget document due to Government Finance Officers Association

January 6 Finance Deadline Final budget document printed and distributed

Page 16