Page 69 - Forest Hill FY20 Annual Budget

P. 69

CITY OF FOREST HILL

DEBT SERVICE FUND

The Debt Service Fund (Interest and Sinking Fund, or I&S) was established for the purpose of servicing

the City’s general obligation debt. Revenue sources for the fund include the interest and sinking (I&S)

portion of the annual ad valorem tax levy, tax collections penalties and interest, interest earnings, and

inter-fund transfers. Debt service payments are forwarded to the designated paying agent bank as semi-

annual principal and interest requirements come due for each debt issue.

AD VALOREM TAX RATE AND DEBT SERVICE LIMIT

The maximum total ad valorem tax rate for home rule cities in the State of Texas (including the

maintenance and operation and interest and sinking portions of the ad valorem tax rate) is limited by

statute to $2.50 per $100 of assessed valuation. A portion of the $2.50 maximum is used for the

maintenance and operations portion of the tax levy. For the issuance of new debt, the State Attorney

General limits the total I&S tax rate to $1.50 (at a 90% collection rate).

The I&S portion of the proposed ad valorem tax rate for 2019-2020 is $0.08157 per $100 of assessed

valuation, or 8.22% of the total adopted tax rate of $0.992873 per $100 valuation.

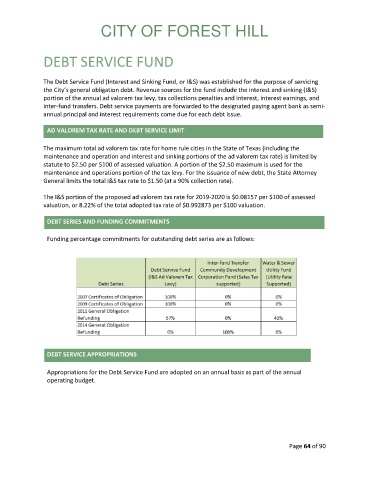

DEBT SERIES AND FUNDING COMMITMENTS

Funding percentage commitments for outstanding debt series are as follows:

DEBT SERVICE APPROPRIATIONS

Appropriations for the Debt Service Fund are adopted on an annual basis as part of the annual

operating budget.

Page 64 of 90