Page 37 - Forest Hill FY20 Annual Budget

P. 37

CITY OF FOREST HILL

AD VALOREM TAXES –COLLECTIONS

For the fiscal year 2019-2020, the property tax levy will amount to approximately $6,009,318 an increase

of 17.86% of the previous fiscal year’s tax levy amount of $5,098,534.

SALES TAX

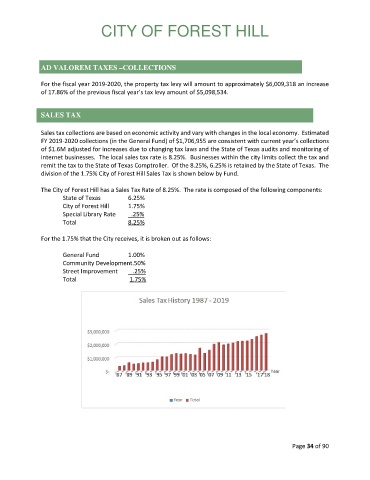

Sales tax collections are based on economic activity and vary with changes in the local economy. Estimated

FY 2019-2020 collections (in the General Fund) of $1,706,955 are consistent with current year’s collections

of $1.6M adjusted for increases due to changing tax laws and the State of Texas audits and monitoring of

internet businesses. The local sales tax rate is 8.25%. Businesses within the city limits collect the tax and

remit the tax to the State of Texas Comptroller. Of the 8.25%, 6.25% is retained by the State of Texas. The

division of the 1.75% City of Forest Hill Sales Tax is shown below by Fund.

The City of Forest Hill has a Sales Tax Rate of 8.25%. The rate is composed of the following components:

State of Texas 6.25%

City of Forest Hill 1.75%

Special Library Rate .25%

Total 8.25%

For the 1.75% that the City receives, it is broken out as follows:

General Fund 1.00%

Community Development.50%

Street Improvement .25%

Total 1.75%

Page 34 of 90