Page 264 - FY2020Colleyville

P. 264

stated.

Maturity limitations for single issue reserve funds shall not exceed the sooner

of five (5) years, the call provisions of the bond ordinance, or the final maturity

of the bond issue.

Reserve funds may be subject to arbitrage rebate rules requiring refunding of

excess earnings. All excess earnings received will be segregated to allow a

proper determination of interest income to be used in the arbitrage

calculation.

(4) Special Project or Special Purpose Funds

The investment strategy for special projects or special purpose fund

portfolio(s) will have as their primary objective to assure that anticipated cash

flows are matched with adequate investment liquidity. The City’s final

maturity dates of securities held shall not exceed the estimated project

completion date. Funds in excess of defined construction payment schedules

shall be limited to a maximum final maturity date of three years.

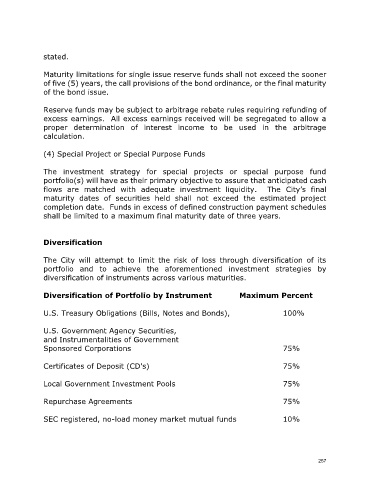

Diversification

The City will attempt to limit the risk of loss through diversification of its

portfolio and to achieve the aforementioned investment strategies by

diversification of instruments across various maturities.

Diversification of Portfolio by Instrument Maximum Percent

U.S. Treasury Obligations (Bills, Notes and Bonds), 100%

U.S. Government Agency Securities,

and Instrumentalities of Government

Sponsored Corporations 75%

Certificates of Deposit (CD's) 75%

Local Government Investment Pools 75%

Repurchase Agreements 75%

SEC registered, no-load money market mutual funds 10%

257