Page 70 - Benbrook FY20 Approved Budget

P. 70

CITY OF BENBROOK 2019-20 ANNUAL BUDGET

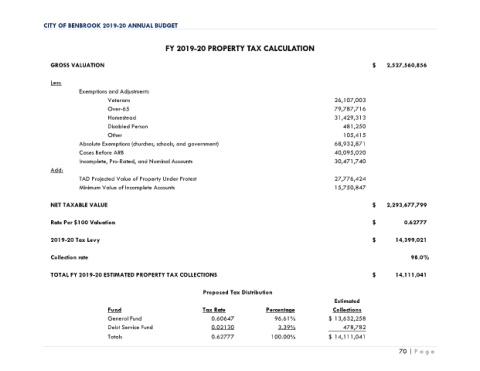

FY 2019-20 PROPERTY TAX CALCULATION

GROSS VALUATION $ 2,527,560,856

Less:

Exemptions and Adjustments

Veterans 26,107,003

Over-65 79,787,716

Homestead 31,429,313

Disabled Person 481,250

Other 105,415

Absolute Exemptions (churches, schools, and government) 68,932,871

Cases Before ARB 40,095,020

Incomplete, Pro-Rated, and Nominal Accounts 30,471,740

Add:

TAD Projected Value of Property Under Protest 27,776,424

Minimum Value of Incomplete Accounts 15,750,847

NET TAXABLE VALUE $ 2,293,677,799

Rate Per $100 Valuation $ 0.62777

2019-20 Tax Levy $ 14,399,021

Collection rate 98.0%

TOTAL FY 2019-20 ESTIMATED PROPERTY TAX COLLECTIONS $ 14,111,041

Proposed Tax Distribution

Estimated

Fund Tax Rate Percentage Collections

General Fund 0.60647 96.61% $ 13,632,258

Debt Service Fund 0.02130 3.39% 478,782

Totals 0.62777 100.00% $ 14,111,041

70 | P a g e