Page 328 - Benbrook FY20 Approved Budget

P. 328

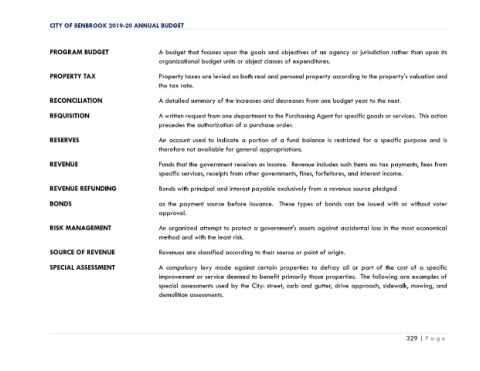

CITY OF BENBROOK 2019-20 ANNUAL BUDGET

PROGRAM BUDGET A budget that focuses upon the goals and objectives of an agency or jurisdiction rather than upon its

organizational budget units or object classes of expenditures.

PROPERTY TAX Property taxes are levied on both real and personal property according to the property's valuation and

the tax rate.

RECONCILIATION A detailed summary of the increases and decreases from one budget year to the next.

REQUISITION A written request from one department to the Purchasing Agent for specific goods or services. This action

precedes the authorization of a purchase order.

RESERVES An account used to indicate a portion of a fund balance is restricted for a specific purpose and is

therefore not available for general appropriations.

REVENUE Funds that the government receives as income. Revenue includes such items as: tax payments, fees from

specific services, receipts from other governments, fines, forfeitures, and interest income.

REVENUE REFUNDING Bonds with principal and interest payable exclusively from a revenue source pledged

BONDS as the payment source before issuance. These types of bonds can be issued with or without voter

approval.

RISK MANAGEMENT An organized attempt to protect a government's assets against accidental loss in the most economical

method and with the least risk.

SOURCE OF REVENUE Revenues are classified according to their source or point of origin.

SPECIAL ASSESSMENT A compulsory levy made against certain properties to defray all or part of the cost of a specific

improvement or service deemed to benefit primarily those properties. The following are examples of

special assessments used by the City: street, curb and gutter, drive approach, sidewalk, mowing, and

demolition assessments.

329 | P a g e