Page 226 - Benbrook FY20 Approved Budget

P. 226

CITY OF BENBROOK 2019-20 ANNUAL BUDGET

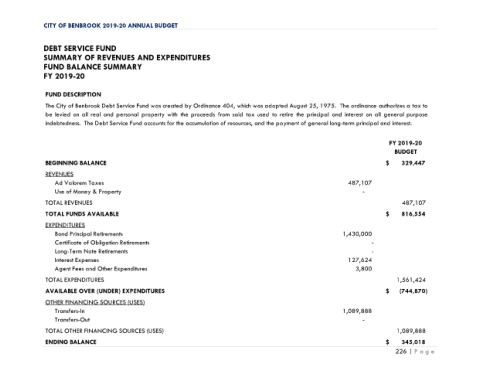

DEBT SERVICE FUND

SUMMARY OF REVENUES AND EXPENDITURES

FUND BALANCE SUMMARY

FY 2019-20

FUND DESCRIPTION

The City of Benbrook Debt Service Fund was created by Ordinance 404, which was adopted August 25, 1975. The ordinance authorizes a tax to

be levied on all real and personal property with the proceeds from said tax used to retire the principal and interest on all general purpose

indebtedness. The Debt Service Fund accounts for the accumulation of resources, and the payment of general long-term principal and interest.

FY 2019-20

BUDGET

BEGINNING BALANCE $ 329,447

REVENUES

Ad Valorem Taxes 487,107

Use of Money & Property -

TOTAL REVENUES 487,107

TOTAL FUNDS AVAILABLE $ 816,554

EXPENDITURES

Bond Principal Retirements 1,430,000

Certificate of Obligation Retirements -

Long-Term Note Retirements -

Interest Expenses 127,624

Agent Fees and Other Expenditures 3,800

TOTAL EXPENDITURES 1,561,424

AVAILABLE OVER (UNDER) EXPENDITURES $ (744,870)

OTHER FINANCING SOURCES (USES)

Transfers-In 1,089,888

Transfers-Out -

TOTAL OTHER FINANCING SOURCES (USES) 1,089,888

ENDING BALANCE $ 345,018

226 | P a g e