Page 130 - Benbrook FY20 Approved Budget

P. 130

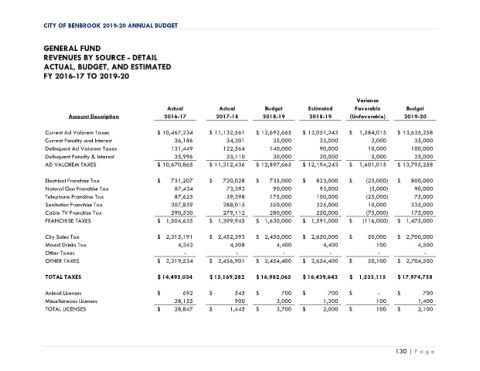

CITY OF BENBROOK 2019-20 ANNUAL BUDGET

GENERAL FUND

REVENUES BY SOURCE - DETAIL

ACTUAL, BUDGET, AND ESTIMATED

FY 2016-17 TO 2019-20

Variance

Actual Actual Budget Estimated Favorable Budget

Account Description 2016-17 2017-18 2018-19 2018-19 (Unfavorable) 2019-20

Current Ad Valorem Taxes $ 10,467,234 $ 11,132,561 $ 12,692,665 $ 12,051,243 $ 1,584,015 $ 13,635,258

Current Penalty and Interest 36,186 34,201 35,000 33,000 2,000 35,000

Delinquent Ad Valorem Taxes 131,449 122,564 140,000 90,000 10,000 100,000

Delinquent Penalty & Interest 35,996 23,110 30,000 20,000 5,000 25,000

AD VALOREM TAXES $ 10,670,865 $ 11,312,436 $ 12,897,665 $ 12,194,243 $ 1,601,015 $ 13,795,258

Electrical Franchise Tax $ 731,207 $ 720,028 $ 735,000 $ 823,000 $ (23,000) $ 800,000

Natural Gas Franchise Tax 87,434 73,392 90,000 93,000 (3,000) 90,000

Telephone Franchise Tax 87,625 39,398 175,000 100,000 (25,000) 75,000

Sanitation Franchise Tax 307,839 288,015 350,000 325,000 10,000 335,000

Cable TV Franchise Tax 290,530 279,112 280,000 250,000 (75,000) 175,000

FRANCHISE TAXES $ 1,504,635 $ 1,399,945 $ 1,630,000 $ 1,591,000 $ (116,000) $ 1,475,000

City Sales Tax $ 2,315,191 $ 2,452,393 $ 2,450,000 $ 2,650,000 $ 50,000 $ 2,700,000

Mixed Drinks Tax 4,343 4,508 4,400 4,400 100 4,500

Other Taxes - - - - - -

OTHER TAXES $ 2,319,534 $ 2,456,901 $ 2,454,400 $ 2,654,400 $ 50,100 $ 2,704,500

TOTAL TAXES $ 14,495,034 $ 15,169,282 $ 16,982,065 $ 16,439,643 $ 1,535,115 $ 17,974,758

Animal Licenses $ 692 $ 545 $ 700 $ 700 $ - $ 700

Miscellaneous Licenses 28,155 900 3,000 1,300 100 1,400

TOTAL LICENSES $ 28,847 $ 1,445 $ 3,700 $ 2,000 $ 100 $ 2,100

130 | P a g e