Page 90 - City of Bedford FY20 Approved Budget

P. 90

CITY OF BEDFORD

OVERLAPPING

TAX RATES

FY 2019 – 2020

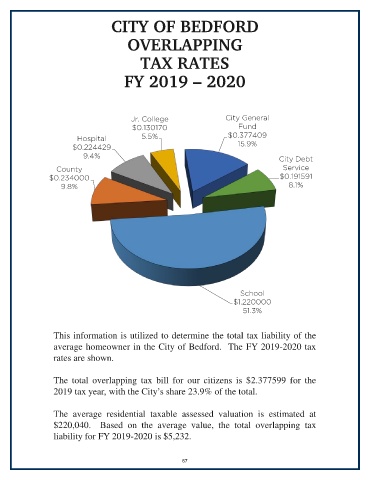

Jr. College City General

$0.130170 Fund

Hospital 5.5% $0.377409

$0.224429 15.9%

9.4% City Debt

County Service

$0.234000 $0.191591

9.8% 8.1%

School

$1.220000

51.3%

This information is utilized to determine the total tax liability of the

average homeowner in the City of Bedford. The FY 2019-2020 tax

rates are shown.

The total overlapping tax bill for our citizens is $2.377599 for the

2019 tax year, with the City’s share 23.9% of the total.

The average residential taxable assessed valuation is estimated at

$220,040. Based on the average value, the total overlapping tax

liability for FY 2019-2020 is $5,232.

67