Page 363 - City of Bedford FY20 Approved Budget

P. 363

of Official Statements and take responsibility for the accuracy of all financial

information released.

E. Federal Requirements. The City will maintain procedures to comply with

arbitrage rebate and other federal requirements.

F. Debt Limit. The State of Texas limits the ad valorem tax rate to $2.50 per $100

valuation. The City of Bedford’s 2019-2020 proposed tax rate as presented falls

well below this limit.

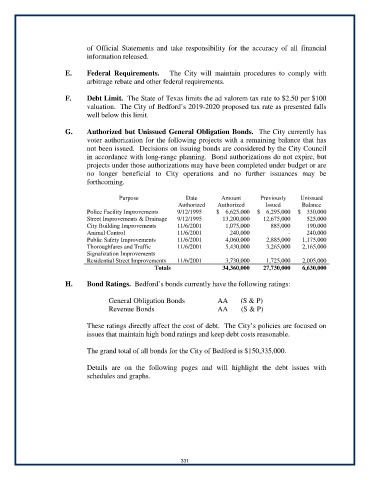

G. Authorized but Unissued General Obligation Bonds. The City currently has

voter authorization for the following projects with a remaining balance that has

not been issued. Decisions on issuing bonds are considered by the City Council

in accordance with long-range planning. Bond authorizations do not expire, but

projects under those authorizations may have been completed under budget or are

no longer beneficial to City operations and no further issuances may be

forthcoming.

Purpose Date Amount Previously Unissued

Authorized Authorized Issued Balance

Police Facility Improvements 9/12/1995 $ 6,625,000 $ 6,295,000 $ 330,000

Street Improvements & Drainage 9/12/1995 13,200,000 12,675,000 525,000

City Building Improvements 11/6/2001 1,075,000 885,000 190,000

Animal Control 11/6/2001 240,000 - 240,000

Public Safety Improvements 11/6/2001 4,060,000 2,885,000 1,175,000

Thoroughfares and Traffic 11/6/2001 5,430,000 3,265,000 2,165,000

Signalization Improvements

Residential Street Improvements 11/6/2001 3,730,000 1,725,000 2,005,000

Totals 34,360,000 27,730,000 6,630,000

H. Bond Ratings. Bedford’s bonds currently have the following ratings:

General Obligation Bonds AA (S & P)

Revenue Bonds AA (S & P)

These ratings directly affect the cost of debt. The City’s policies are focused on

issues that maintain high bond ratings and keep debt costs reasonable.

The grand total of all bonds for the City of Bedford is $150,335,000.

Details are on the following pages and will highlight the debt issues with

schedules and graphs.

331